This article explains how to configure taxes for Shopify stores based in Lithuania.

Caution

On January 1, 2025, new EU VAT regulations came into force. Among others, EU introduced a new Simplified VAT scheme for small and medium-sized enterprises (SMEs).

Under this new scheme, businesses with annual turnover below €100,000 across the EU may now qualify to be VAT-exempt. This is subject to national implementation of the EU legislation, so we recommend you consult your local tax authority.

We are currently updating this article to reflect the changes.

If you’ve found your way here, chances are you know VAT can be a real pain.

With different rates, thresholds, and transaction-specific rules, navigating VAT can feel like tiptoeing through a minefield.

This is exactly why we’ve put together this super simple VAT guide for Shopify stores in Lithuania. You’ll learn about selling goods to customers in other EU countries, selling outside of the EU, what the important thresholds are, and much more!

Just remember, the most significant distinction for your business is whether it is VAT registered or not. You can learn more about this topic in our VAT guide for Shopify stores in the EU.

If you want to charge VAT to some customers and not to others, you may choose from two settings, depending on how you want to display product prices in your Shopify store.

If you are selling predominantly to consumers (B2C), you may prefer to display product prices as including VAT.

To display your product prices including VAT, but still allow your business customers to have VAT deducted at checkout:

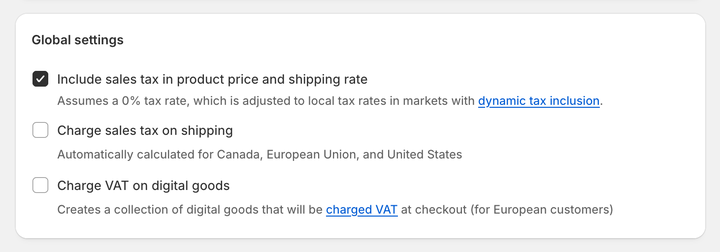

- In your Shopify admin, go to the Settings → Taxes and duties page.

- In the Global settings section, check the Include sales tax in product price and shipping rate.

- Click on Save to apply the changes.

Optionally, you can enable dynamic tax inclusion. This Shopify feature automatically includes or excludes the tax based on the customer's region and adjusts the tax rate accordingly.

To activate dynamic tax inclusion:

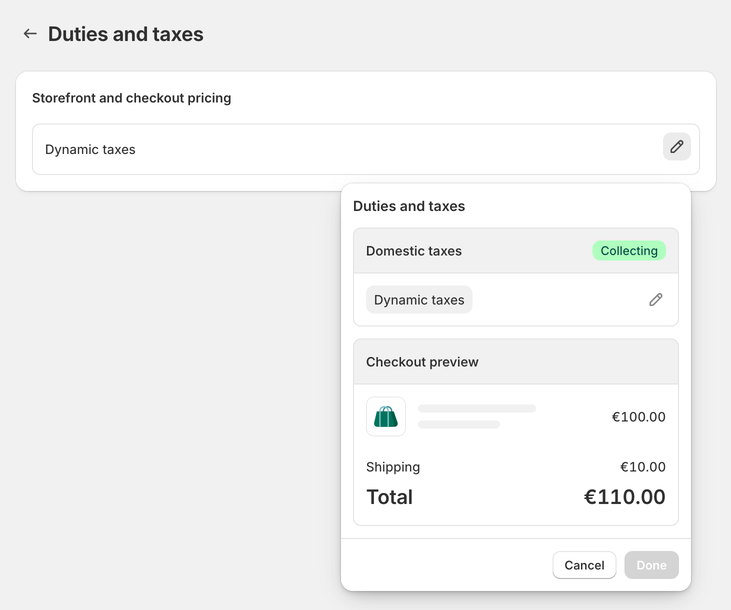

- In your Shopify admin, go to the Settings → Markets and click on the market for which you want to set up tax collection.

- Click on Duties and taxes and in the Storefront and checkout pricing field, click on Edit.

- In the Domestic taxes field, select the Dynamic taxes option. Click on Done.

- Click on Save to apply the changes.

In case your customers are mostly businesses (B2B), you can choose to have your product prices displayed as excluding VAT.

To display your product prices excluding VAT:

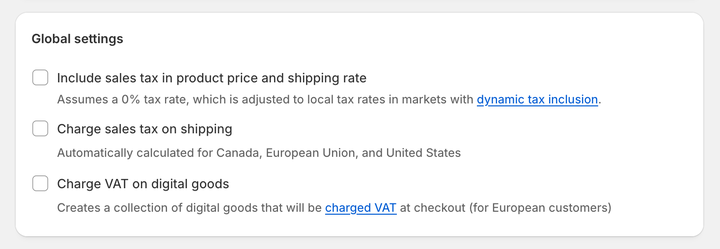

- In your Shopify admin, go to the Settings → Taxes and duties page.

- In the Global settings section, uncheck the Include sales tax in product price and shipping rate.

- Click on Save to apply the changes.

Optionally, disable the dynamic tax inclusion:

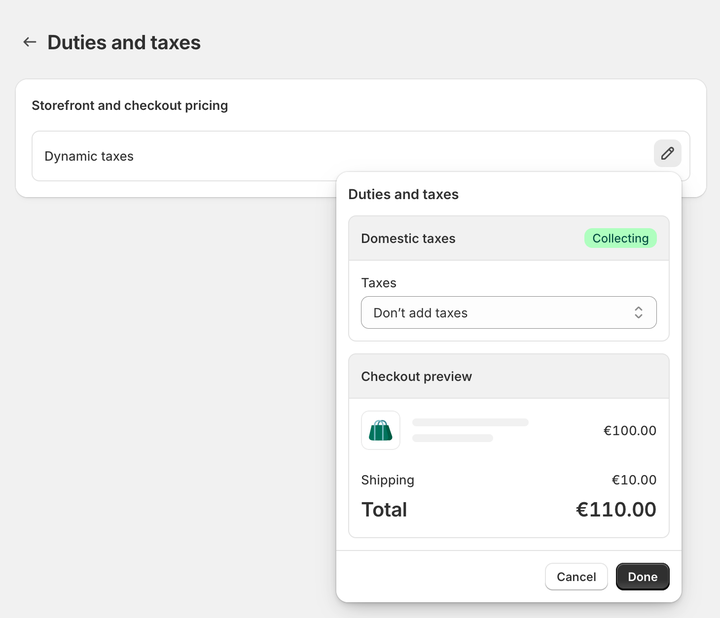

- In your Shopify admin, go to the Settings → Markets and click on the market for which you want to set up tax collection.

- Click on Duties and taxes and in the Storefront and checkout pricing field, click on Edit.

- In the Domestic taxes field, select the Don't add taxes option. Click on Done.

- Click on Save to apply the changes.

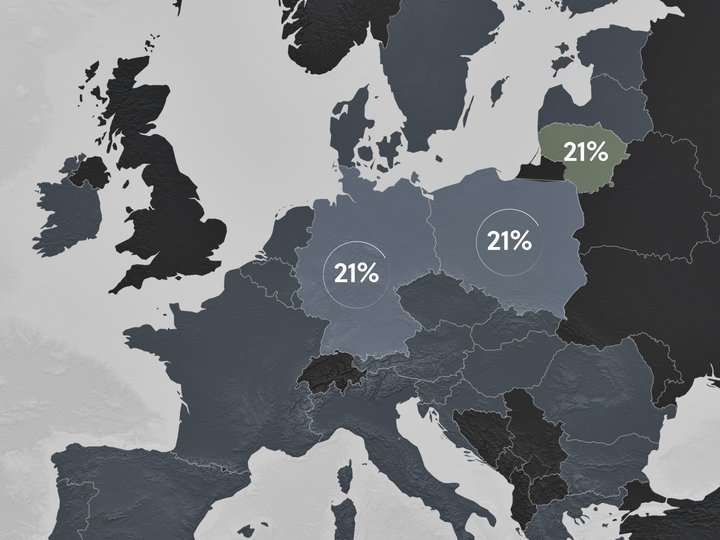

The standard rate of VAT in Lithuania is 21%. Goods are subject to the standard rate unless they are reduced (9% rate) or zero-rated (5% rate).

For information on what goods are charged at the reduced rates or zero-rated, see: Value Added Tax - VMI.

If you are selling goods to customers—either businesses (B2B) or consumers (B2C)—in Lithuania, then you must charge Lithuanian VAT.

If your business is not VAT-registered, you do not charge VAT. You also cannot include VAT on your invoices until you register your business for VAT.

When the taxable part of your business’s turnover exceeds EUR 45,000 in 12 months, you must register for VAT. You can also voluntarily register at any time.

In Lithuania, you are also required to register for VAT if the goods you purchase from other European Union (EU) member states exceeded EUR 14,000 in the previous calendar year or is expected to exceed this threshold in the current calendar year. This means that you must register for VAT even if your taxable turnover is less than EUR 45,000.

Note

You can register by submitting a VAT registration application via Lithuania’s State Tax inspectorate’s online service system, My STI.

If your business is in Lithuania and you are VAT-registered, you must charge VAT to some customers but not others. It all depends on where they are located.

If you are selling goods B2B in other EU member states, then these sales are zero-rated for VAT. This means that you put the VAT on your invoices, but you charge VAT at 0%. Under the reverse-charge mechanism rules, the customer will account for the VAT.

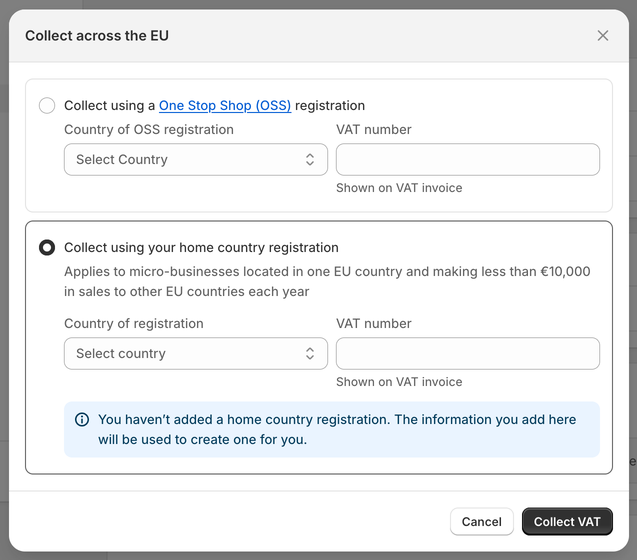

If you are selling goods B2C in other EU member states, then you charge VAT. However, the rate of VAT depends on whether you surpass the “micro-business” threshold.

If your taxable turnover during a calendar year outside your home country (but still within the EU) does not surpass a threshold of €10,000 (excluding VAT), you qualify for the micro-business exemption. Once you apply for it at your local tax authority, you will charge the VAT rate of the country your business is based in.

To use the "micro-business" taxation scheme, you need to apply for the "micro-business" exemption at your local tax authority. You will use just one VAT registration within the EU.

Then, you can set up your tax settings in your Shopify admin. This task only needs to be performed once.

To set VAT rates for the "micro-business" exemption scheme and charge your home country's VAT rates on all orders:

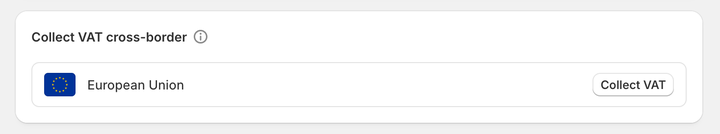

- In your Shopify admin, go to the Settings → Taxes and duties page.

- In the Regional settings section, click on European Union.

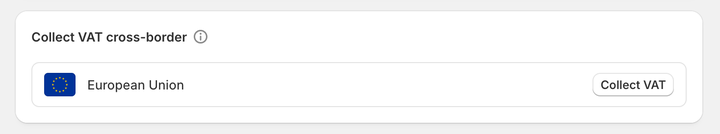

- In the Collect VAT cross-border section, click on Collect VAT.

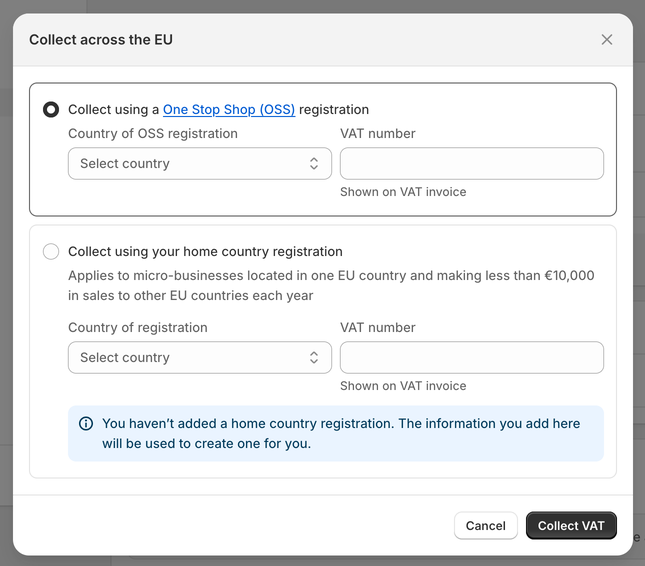

- In the Collect across the EU window, select the Collect using your home country registration option.

- Select your Country of registration and enter your VAT number. Leave this field blank if you have applied for a VAT registration number but don't have one yet. You can update it later when you receive it.

- Save your changes by clicking on the Collect VAT button.

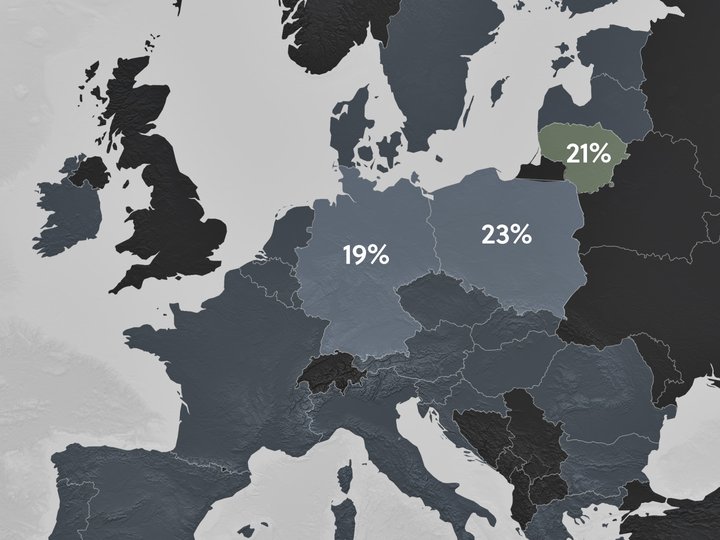

If the total value of your sales to any EU Member State during a calendar year exceeds the threshold of EUR 10,000 (excluding VAT), you charge the VAT rate of the country you are shipping to.

As a result, you will charge different VAT rates to customers from other EU countries, varying from country to country (from 15% to 27%).

If you breach the threshold by selling to multiple countries, registering for VAT in each EU member state can become admin heavy. In this case, you can choose to use the One-Stop Shop (OSS) Union scheme, which means you still charge VAT at the rate of the country where you are selling, but you only have to report on one OSS VAT return.

Shopify allows you to set these tax settings for individual VAT registrations and automatically charge the correct taxes to your EU customers.

For further information on selling goods between EU member states, see: VAT guide for Shopify stores in the EU or read our blog post about the updated EU VAT rules.

To charge your customers abroad with the correct VAT rate, you need to set your tax settings accordingly. Shopify gives you the option to select OSS as your VAT registration type, allowing you to charge correct VAT rates automatically.

To set VAT rates for the OSS scheme and charge your customers' shipping country VAT rates on all orders:

- In your Shopify admin, go to the Settings → Taxes and duties page.

- In the Regional settings section, click on European Union.

- In the Collect VAT cross-border section, click on Collect VAT.

- In the Collect across the EU window, select the Collect using a One Stop Shop (OSS) registration option.

- Select your Country of OSS registration and enter your VAT number. Leave this field blank if you have applied for a VAT registration number but don't have one yet. You can update it later when you receive it.

- Save your changes by clicking on the Collect VAT button.

Now, your customers' shipping country VAT rates automatically apply to all EU sales.

Some businesses may decide to continue to hold tax registration for each EU country they ship to. If that is your case, in Shopify, you are able to add a local VAT registration number for a different country, which allows you to charge the correct VAT rates. Shopify will then automatically apply VAT rates based on your VAT registration.

To add the local VAT registration number:

- In your Shopify admin, go to the Settings → Taxes and duties page.

- In the Regional settings section, click on European Union.

- In the Collect VAT in an EU country section, click on Collect in another location.

- Select the Registration country and enter your VAT number. If you have applied for a VAT registration number but don't have one yet, leave this field blank. You can update it later when you receive it.

- Save your changes by clicking on the Collect VAT button.

- To add the local VAT registration number for every country you are registered in click, on the Collect VAT in an EU country option and confirm the selection by clicking on the Collect VAT button.

If you are not able to select the additional country you are VAT-registered in, you may need to create a shipping zone first.

To create a shipping zone:

- In your Shopify admin, go to the Settings → Shipping and delivery page.

- In the Shipping section, click on the shipping profile that you want to add shipping zones to.

- In the Shipping zones section, click on Add shipping zone.

- Type in the name of the shipping zone, add the country (or countries) you are VAT-registered in using the search bar, and when finished, click on Done.

- To make this zone available, add the shipping rates.

- Click on Save to apply changes.

There are special rules for selling digital goods from Lithuania to other EU countries. But firstly, it is critical to understand what exactly digital services are.

Digital goods or services include radio and television broadcasting services, telecommunication services, and electronically supplied services, such as online magazines, music, films, and games.

Even though a company uses the internet to facilitate trading, this does not always mean that they provide e-services. For example, the sale of goods where the order and processing are done electronically (such as through a Shopify store) is not a supply of digital services. This is regarded as a sale of goods and follows the usual VAT rules set out above.

If you are making supplies of digital services from Lithuania to other EU countries or to UK consumers, there is no registration threshold (such as the exemption for micro-businesses of €10,000).

Therefore, if you are selling to non-VAT registered customers (B2C), you must register for VAT in that country and charge its VAT rate. This means that customers from different EU countries should be charged with different VAT rates, varying from 16% to 27%.

If you are selling digital goods to VAT-registered businesses (B2B), then they are responsible for any VAT due to the tax authorities in their country.

Having to register for VAT in multiple countries can be quite time-consuming. Shopify store owners in Lithuania selling to other countries in the EU (excluding Northern Ireland) can register for VAT One Stop Shop (OSS). The OSS scheme allows businesses to report the VAT due on services in their own Member State via a web portal.

To learn more, please see this article to find out how to set up EU taxes for selling digital goods.

If you are selling goods from Lithuania outside of the EU—whether B2B or B2C—these sales are exempt from VAT. This means that you do not charge VAT on your invoices.

Once you set your tax rates correctly in your store, Sufio will automatically create valid invoices with an exact breakdown of the charged VAT.

Invoices can be created in multiple languages and include all the necessary details to make them compliant with invoicing legislation in the EU.

Issuing invoices with the correct tax breakdown is crucial for your bookkeeping and tax purposes.

If you are selling to businesses (B2B), Sufio invoices include all the required information, as well as the VAT registration number for your Shopify store and your business.

For personalised advice based on your specific business situation, consider consulting with a tax professional or accountant who specialises in VAT and ecommerce. You can do this by searching for a local tax advisor in your area.

Last updated on March 17, 2025.

Professional invoices for Shopify stores

Let Sufio automatically create and send beautiful invoices for every order in your store.

Install Sufio - Automatic Invoices from the Shopify App Store