If you are a Shopify store owner based in the European Union, it is crucial to understand when to charge VAT or even which tax rate applies to which customer.

This article will help you understand this topic and correctly set up your online store.

Caution

On January 1, 2025, new EU VAT regulations came into force. Among others, EU introduced a new Simplified VAT scheme for small and medium-sized enterprises (SMEs).

Under this new scheme, businesses with annual turnover below €100,000 across the EU may now qualify to be VAT-exempt. This is subject to national implementation of the EU legislation, so we recommend you consult your local tax authority.

We are currently updating this article to reflect the changes.

Many businesses start as unregistered. However, once their annual taxable turnover in the country their business is based in is above a certain threshold, they need to register for VAT. This threshold is around €35,000 in some EU countries and €100,000 in others.

The most significant distinction for your business is whether it is VAT-registered or not.

If your taxable turnover in the last twelve months is below the country's VAT registration limit where your store is based, it is most likely not VAT-registered.

This means that you do not charge VAT on your sales regardless of where your customers come from.

If your business is VAT-registered, you have to charge VAT to some customers, but not to others. The table below shows whom you need to charge VAT and when.

Two factors determine whether you should charge VAT or not — what country your customer is in and whether you are selling to a consumer (B2C) or a business (B2B).

| Customers from | Consumers (B2C) | Businesses (B2B) |

|---|---|---|

| The same EU country | VAT | VAT |

| A different EU country | VAT | No VAT |

| Outside the EU | No VAT | No VAT |

You also need to include your VAT registration number on your invoices and receipts to make them valid.

When selling to consumers (B2C) and businesses (B2B) in your home country, you should always charge VAT and use the applicable VAT rate in your country. This applies to selling both physical and digital goods.

When selling to customers from other EU countries, you need to distinguish between selling to consumers and businesses.

Consumers from different EU countries

When selling to consumers (B2C) from other EU countries, you should always charge VAT. Which VAT rate to apply depends on the type of VAT registration you have.

Selling as a "micro-business"

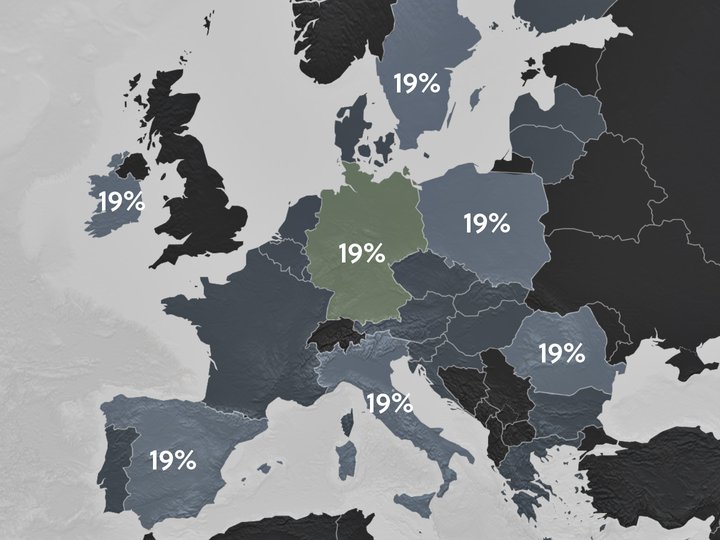

If your taxable turnover during a calendar year outside your home country but still within the EU does not surpass a threshold of €10,000 (excluding VAT), you qualify for the micro-business exemption. Once you apply for it at your local tax authority, you will charge the VAT rate of the country your business is based in.

Surpassing the micro-business threshold

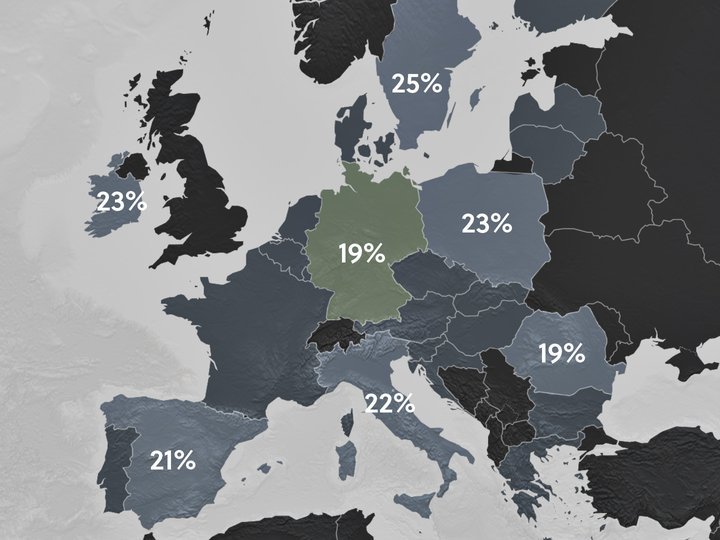

If your taxable turnover during a calendar year outside your home country but still within the EU exceeds the threshold of €10,000 (excluding VAT), you charge the VAT rate of the country you are shipping to.

As a result, you will be charging different VAT rates to customers from other EU countries, varying from country to country (from 15% to 27%).

Shopify allows you to set these tax settings for individual VAT registrations and charge the correct taxes to your EU customers automatically.

Businesses from different EU countries

When selling to businesses with valid VAT registration numbers from other EU countries, you do not charge VAT for either physical or digital goods.

Such customers should be marked as tax-exempt in your Shopify store. Moreover, you should capture and validate your business customers' VAT registration numbers prior to allowing them to purchase your products.

With Sufio, you can capture and validate EU VAT registration numbers from your business customers and, if applicable, set them as tax-exempt.

Additionally, Sufio creates invoices that include all the necessary details to make them compliant with your invoicing legislation. Invoices can serve as valid documentation to show that your products were shipped to another EU member country.

When selling to customers outside the EU, you should not charge VAT on any goods.

You will still need to report the sales VAT for taxation purposes, as sales with 0% VAT. Valid invoices, such as those created by Sufio, can serve as proof that the goods were shipped outside of the EU.

Caution

As of January 1, 2021, the UK is no longer part of the EU. Consequently, new regulations apply to direct sales between the UK and the European Union.

When selling to consumers (B2C) or businesses (B2B) from the EU directly to the UK, you must register for a UK VAT registration number. The applicable VAT rate is based on the total value of the order. Orders worth less than £135 are subject to 20% VAT at the point of sale. Orders worth over £135 are subject to import VAT rules.

Last updated on January 14, 2022

Invoices for Shopify stores in the EU

Let Sufio automatically send invoices and receipts for every order made in your store.

Get Sufio - Invoices for EU stores from the Shopify App Store