New EU VAT Rules Starting July 2021, and What They Mean for Your Online Store

While “death and taxes” are often said to be the only certainties in this life, the latter is often subject to a state of flux. Significant change is coming soon to the established EU VAT rules surrounding cross-border selling, which will have an important impact on ecommerce globally.

Merchants trading within or to this block need to sit up and pay attention ahead of the adjustments, which will come into effect from July 1, 2021.

In this article, we’ll outline some of the main points to be aware of and highlight a few actions that you might wish to take in preparation.

EU VAT Rules: What’s Changing And Why?

Let’s start with the why. The hope is that the set of changes rolling out in July will help to simplify and streamline the procedures and administration surrounding cross-border ecommerce within the EU.

Three main objectives were:

- Bring VAT rules up to date, in line with modern ways of trading.

- Simplify VAT obligations, making it easier to sell cross-border.

- Combat VAT fraud to level the playing field between European and non-European businesses.

The changes impact two sets of merchants — those which are commonly referred to as “distance sellers” (i.e., an EU-based business selling to another EU country) and non-EU businesses exporting goods to EU-based buyers.

Let’s break down the changes for each separate set of merchants.

Changes For EU-Based Businesses Selling Within The EU

When it comes to distance sellers — EU-based businesses selling to other countries within the EU, there are three main changes to be aware of.

1. No More Distance Selling Thresholds

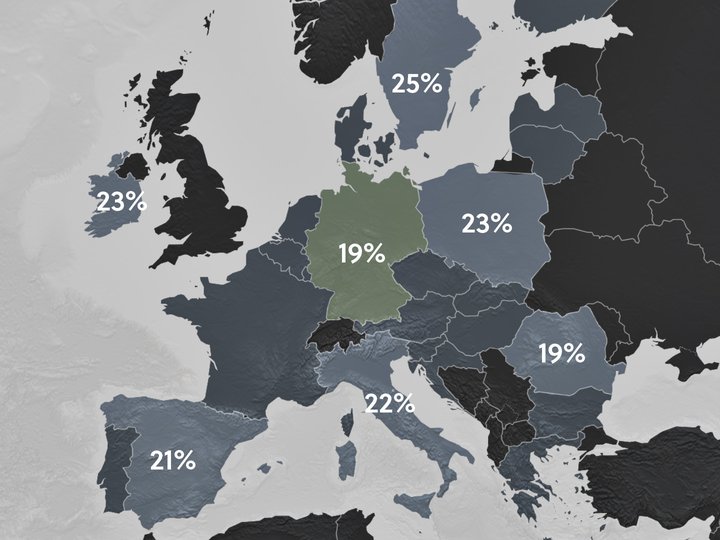

Up until now, once a certain selling threshold had been reached, EU-based businesses were required to register for VAT in the EU country that they were selling to. These distance selling thresholds were different, country to country — higher in some (€100,000 in Luxembourg) and lower in others (€35,000 in Finland).

From July 1, these distance selling thresholds will no longer be enforced. Instead, a common threshold of €10,000 will apply. Distance sellers with sales above this threshold, selling goods across the EU, will be asked to charge VAT at the rate of the buyer’s country of residence.

However, what if sales are not greater than €10,000? If distance sellers are small businesses selling less than €10,000 per annum to buyers in other EU countries, these businesses are considered a “micro-business.” What’s a micro-business, and how will things work for them?

2. Exemption For Micro-Businesses

In this context, a micro-business is defined as a business “established in one EU country experiencing sales to all other EU countries combined, that have not exceeded €10,000 a year.”

Regardless of which EU country the delivery is headed to, businesses that fall into this category may still charge the VAT rate of the EU country the shipment is made from. They can continue remitting to their local tax authority.

3. The Introduction Of A Unifying “One-Stop Shop” (OSS)

Distance sellers currently have to apply for a VAT number and submit local VAT returns in every EU country in which they cross those all-important thresholds.

The introduction of the new “One-Stop Shop” (OSS) scheme will do away with this requirement in a bid to streamline the process. After the changes come into effect, you’ll simply make a single declaration for all your transactions throughout Europe. There will no longer be an obligation to register for VAT in each EU country where sales are made.

There are two exceptions to this new rule: (1) VAT registration will still be required for sales made within the EU country that the business counts as its home country. (2) VAT registration will also be needed for any domestic supply within an EU country where the business holds stock or maintains a physical location.

It should also be noted that the new process of filing with the OSS is optional. If your business is already registered for VAT in another country and you have no issue with the current process, there’s no obligation to change to the OSS scheme.

Changes For Non-EU Based Businesses Exporting Goods To EU-Based Buyers

There will be two main changes for businesses selling from outside of the EU to EU-based customers.

1. All EU-bound orders will now be subject to VAT

Currently, orders placed by buyers within the EU with a total value of less than €22 were not subject to VAT. On July 1, things will change, and buyers will need to pay VAT on all purchases up to the value of €150. For orders above this €150 threshold, import VAT and duties will continue to apply.

2. Say hello to Import One-Stop Shop (IOSS) filing

Merchants collecting VAT on orders below €150 will be able to use the new Import One-Stop Shop (IOSS) scheme to file a single monthly VAT return to cover all these lower value exports.

To do so, they must register as a ‘non-Union’ taxpayer with the tax authority of any EU member country. Once this is done, they can file quarterly via the OSS. They will still need to file a regular domestic VAT return in at least one EU member country.

The OSS scheme can also be used to declare VAT incurred on imports.

How Might The Upcoming Changes To The EU VAT Rules Impact Your Business?

The intention of these changes is for cross-border selling to become manageable, fairer, and more appealing to merchants. After all, the EU is looking to encourage and support the growth of the ambitious ecommerce businesses operating within its borders.

Every business is different, and so it’s important to do some careful thinking about how these new rules will apply to your unique circumstances.

In some cases, businesses may fall into several categories (for example, distance selling but also offering the sale of goods imported from non-EU sellers through their web stores.) In these instances, several sets of rules may need to be considered and factored into your business's practices.

While things should generally become more simple (once everyone has acclimatized to the change), it’s important to note that obligations around record keeping will be impacted. Merchant submitting electronic quarterly VAT returns via their domestic OSS portal will be required to keep records for all eligible OSS sales for a period of 10 years. Doing this in a compliant fashion could prove costly, especially for younger businesses.

If you’re a non-EU merchant shipping goods to EU buyers, you’ll need to make a decision about how you choose to collect VAT on orders that fall below that €150 limit. Charging the customer ahead of delivery might be off-putting and impact conversion rates, but the other option (of customers being charged the additional fee by the courier upon delivery) can also be expected to have a negative impact on customer experience.

What Action Might You Want To Take In Preparation For The EU VAT Rule Changes?

With less than a month to go until the new changes are applied, the best thing you can do is become well-informed about the impending impact. To help you start to pull together your own plan of action based on your business’s unique position, here are a few starter tips.

Update Your Tax Settings In Shopify

Shopify will automatically update tax settings for sales within the EU (charging the VAT rate of the buyer’s shipping country) from July 1, 2021.

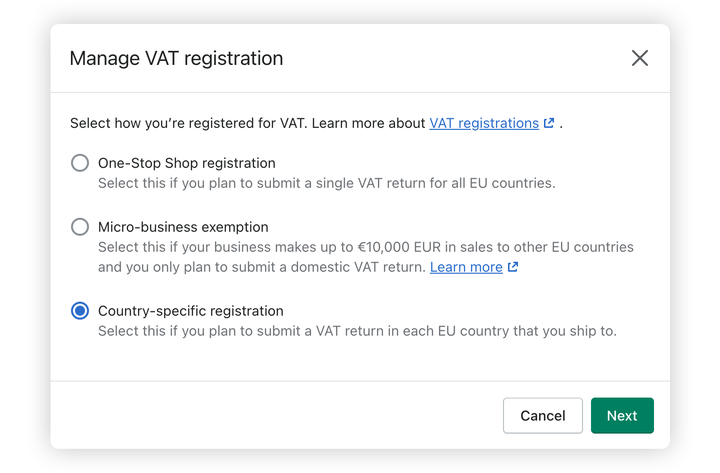

However, in some cases, manual updates will be required on the part of the merchant. These include:

- EU-based micro-businesses who wish to carry on charging VAT based on the rate of their home country.

- EU-based businesses, to reflect their choice of OSS filing or Country-specific registration and filing.

- Non-EU businesses importing products to the EU that wish to charge VAT on orders up to €150. They will need to update their tax settings with their allocated Import One Stop Shop VAT number.

Find out more about updating your Shopify tax settings in our Set up EU taxes in your Shopify store article.

To help you understand this complex topic, we’ve also put together a Shopify tax guide about setting up your tax rates according to the July 2021 EU VAT changes.

Get your free Shopify Tax Guide

Charging your customers the correct tax rates is essential for your business.

Get a free copy of our easy-to-read guide and kick off your sales!

Register For The OSS

If you’re opting to streamline your process via the new OSS scheme, you’ll need to ensure you’re registered. Each EU country will have its own online OSS portal to help facilitate this, and EU-based merchants should use the portal linked to their country of establishment.

Non-EU merchants should register in the country from which their shipments originate, but if goods are shipped from a number of EU countries, then any of these may be selected. As some may be more advantageous to others for your business, it’s wise to seek the advice of a tax professional in these instances. Which brings us neatly on to…

Get Specialist Assistance

Tax can be taxing! If your situation is complex, or you feel at all unsure of the best way to proceed, contact a tax consultant.

If you’re a Non-EU merchant opting to use the IOSS scheme, you may also need to appoint a VAT intermediary, so consider this in good time.

Expert help from our team

Do you have questions about invoicing for your online store? Let's have a chat!

Our team is here to provide answers to your questions and also guide you through setting up Sufio to manage your invoicing effectively.

Book a free consultation

Get Ready For Change And Embrace Opportunity

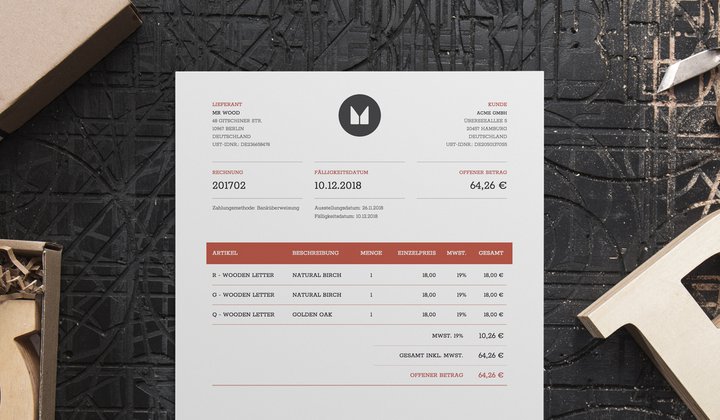

At Sufio, we know a thing or two about tax and cross-border selling — our invoices are designed to be compliant with legislation in the EU and over 50 other countries worldwide.

While any change always takes a while to become accustomed to, we hope that merchants across the ecommerce ecosystem will feel the benefits of a more streamlined system.

Professional invoices for Shopify stores

Let Sufio automatically create and send beautiful invoices for every order in your store.

Install Sufio - Automatic Invoices from the Shopify App Store