This article will help you understand how to set up taxes for Shopify stores based in Latvia.

Caution

On January 1, 2025, new EU VAT regulations came into force. Among others, EU introduced a new Simplified VAT scheme for small and medium-sized enterprises (SMEs).

Under this new scheme, businesses with annual turnover below €100,000 across the EU may now qualify to be VAT-exempt. This is subject to national implementation of the EU legislation, so we recommend you consult your local tax authority.

We are currently updating this article to reflect the changes.

If you’ve reached this page, odds are you’re an entrepreneur with a Shopify store in Latvia. Congratulations! We know setting up a business can be a daunting task, especially when trying to navigate responsibilities like VAT.

If you’re feeling overwhelmed, we can tell you that you’re not alone. With all the different rates, thresholds, and transaction-specific rules, VAT rules can feel like a bit of a maze.

That’s why we’ve put together this super easy VAT guide, made especially for Shopify stores in Latvia. We promise you will reach the bottom of this page feeling ready to conquer any VAT challenge that comes your way!

The most significant distinction for your business is whether it is VAT registered or not. You can learn more about this topic in our VAT guide for Shopify stores in the EU.

- Tax settings

- Tax rates in Latvia and the EU

- Selling goods to customers in Latvia

- Selling goods to customers in other EU Member States

- Selling goods outside of the EU

- Where to find further information

If you want to charge VAT to some customers and not to others, you may choose from two settings, depending on how you want to display product prices in your Shopify store.

If you are selling predominantly to consumers (B2C), you may prefer to display product prices as including VAT.

To display your product prices including VAT, but still allow your business customers to have VAT deducted at checkout:

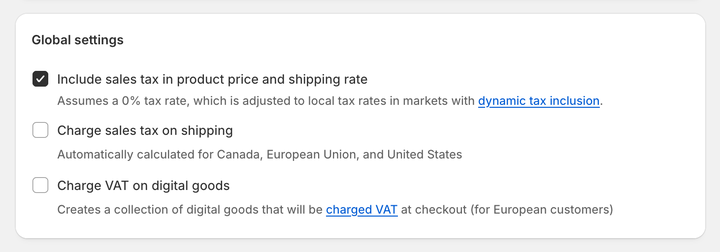

- In your Shopify admin, go to the Settings → Taxes and duties page.

- In the Global settings section, check the Include sales tax in product price and shipping rate.

- Click on Save to apply the changes.

Optionally, you can enable dynamic tax inclusion. This Shopify feature automatically includes or excludes the tax based on the customer's region and adjusts the tax rate accordingly.

To activate dynamic tax inclusion:

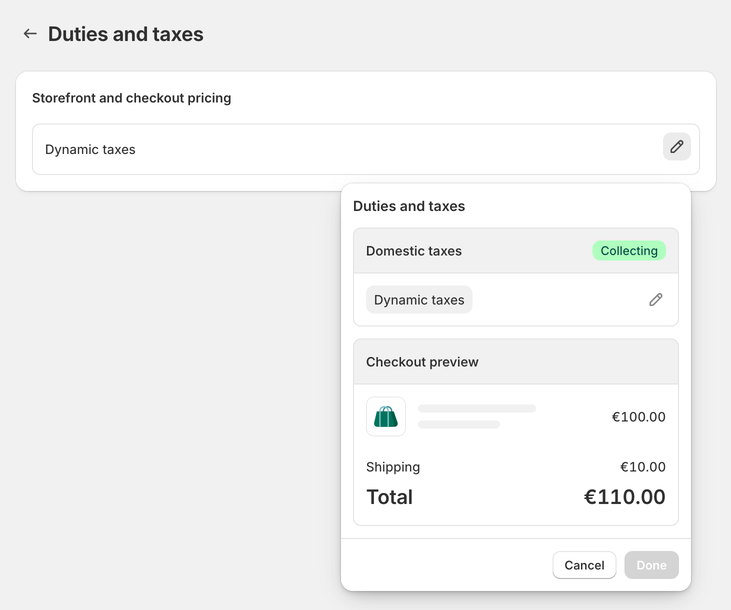

- In your Shopify admin, go to the Settings → Markets and click on the market for which you want to set up tax collection.

- Click on Duties and taxes and in the Storefront and checkout pricing field, click on Edit.

- In the Domestic taxes field, select the Dynamic taxes option. Click on Done.

- Click on Save to apply the changes.

In case your customers are mostly businesses (B2B), you can choose to have your product prices displayed as excluding VAT.

To display your product prices excluding VAT:

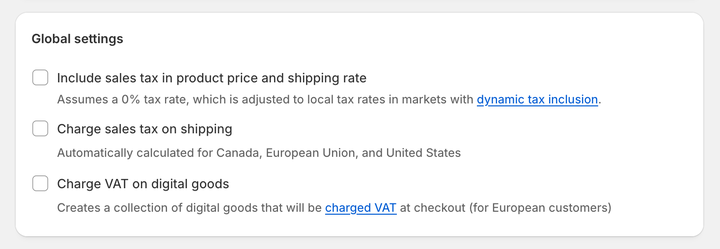

- In your Shopify admin, go to the Settings → Taxes and duties page.

- In the Global settings section, uncheck the Include sales tax in product price and shipping rate.

- Click on Save to apply the changes.

Optionally, disable the dynamic tax inclusion:

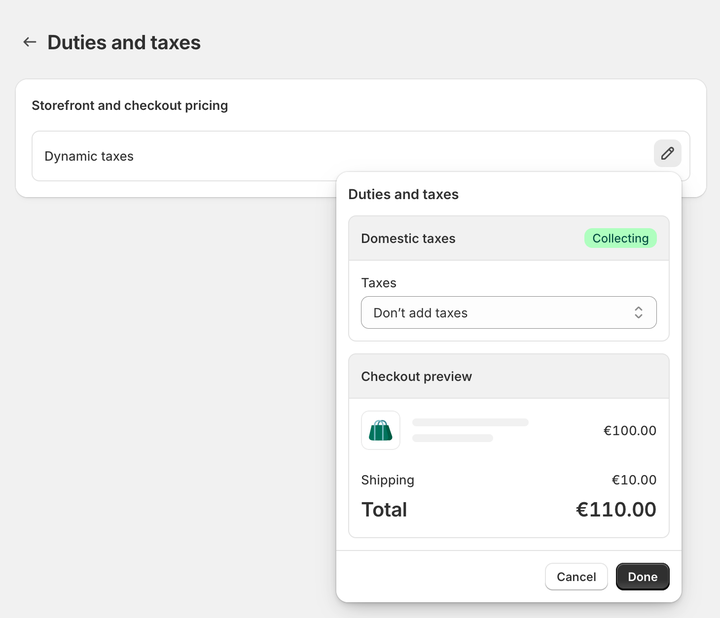

- In your Shopify admin, go to the Settings → Markets and click on the market for which you want to set up tax collection.

- Click on Duties and taxes and in the Storefront and checkout pricing field, click on Edit.

- In the Domestic taxes field, select the Don't add taxes option. Click on Done.

- Click on Save to apply the changes.

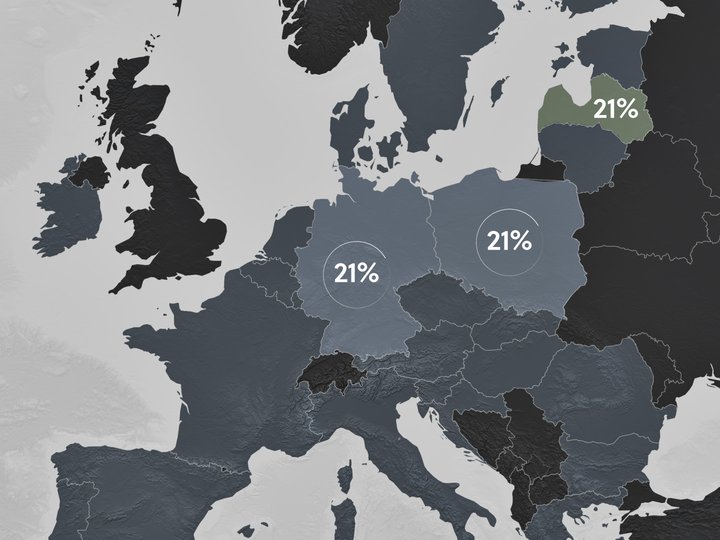

The standard rate of VAT in Latvia is 21%. Goods are subject to the standard rate unless they are charged at the reduced rates of 12% or are zero-rated.

For more information about the rates and applicable persons, see the Latvian State Revenue Service website.

If you are selling goods to customers—either businesses (B2B) or consumers (B2C)—in Latvia, then you must charge Latvian VAT.

If your business is not VAT registered, you do not charge VAT. You also cannot include VAT on your invoices until you register your business for VAT.

Most businesses start as unregistered. When the taxable part of your business’s turnover exceeds EUR 40,000 in a period of 12 months, you must register for VAT. You can also voluntarily register at any time.

Note

You can register electronically, by email or in person. For further information on how to do this, see: Value Added Tax | Valsts ieņēmumu dienests.

If your business is in Latvia and you are VAT registered, you must charge VAT to some customers and not others. It all depends on where your customers are located.

If you are selling goods B2B in other EU Member States, then these sales are zero-rated for VAT. This means that you put the VAT on your invoices, but you charge VAT at 0%. Under the reverse-charge mechanism rules, the customer will account for the VAT.

If you are selling goods B2C in other EU Member States, then you charge VAT. However, the rate of VAT depends on whether you surpass the “micro-business” threshold.

If your taxable turnover during a calendar year outside your home country but still within the EU does not surpass a threshold of €10,000 (excluding VAT), you qualify for the micro-business exemption. Once you apply for it at your local tax authority, you will charge the VAT rate of the country your business is based in.

To use the "micro-business" taxation scheme, you need to apply for the "micro-business" exemption at your local tax authority. You will use just one VAT registration within the EU.

Then, you can set up your tax settings in your Shopify admin. This task only needs to be performed once.

To set VAT rates for the "micro-business" exemption scheme and charge your home country's VAT rates on all orders:

- In your Shopify admin, go to the Settings → Taxes and duties page.

- In the Regional settings section, click on European Union.

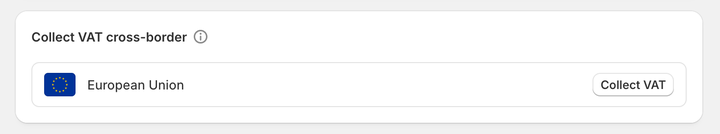

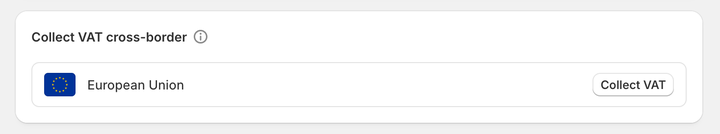

- In the Collect VAT cross-border section, click on Collect VAT.

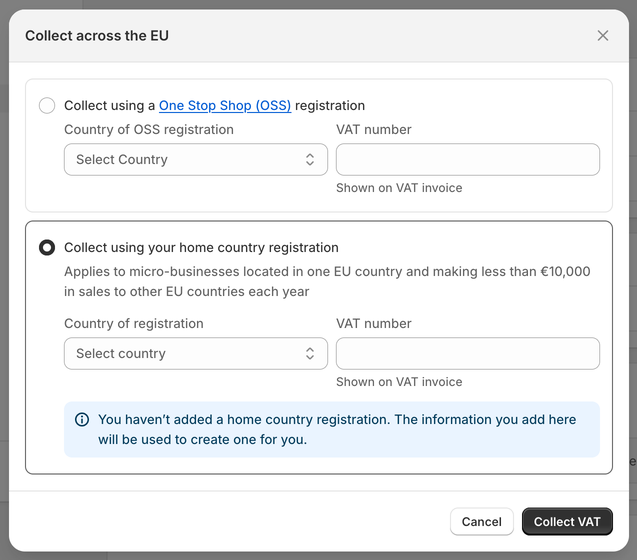

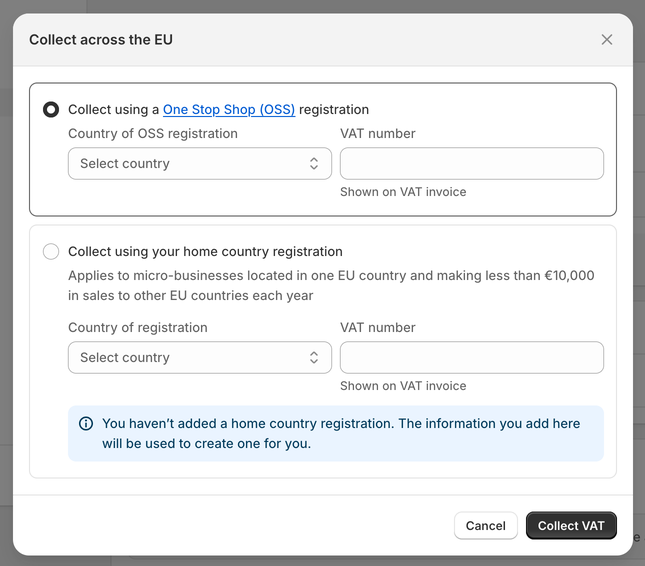

- In the Collect across the EU window, select the Collect using your home country registration option.

- Select your Country of registration and enter your VAT number. Leave this field blank if you have applied for a VAT registration number but don't have one yet. You can update it later when you receive it.

- Save your changes by clicking on the Collect VAT button.

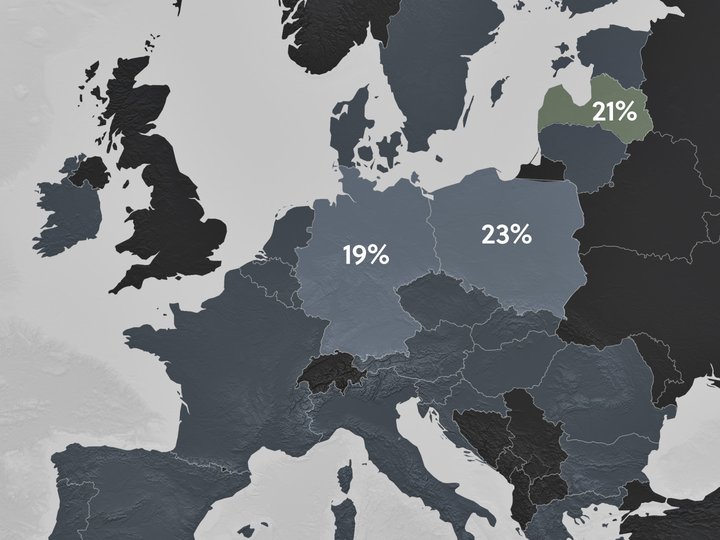

If the total value of your sales to any EU Member State during a calendar year exceeds the threshold of EUR 10,000 (excluding VAT), you charge the VAT rate of the country you are shipping to.

As a result, you will be charging different VAT rates to customers from other EU countries, varying from country to country (from 15% to 27%).

If you breach the threshold by selling to multiple countries, registering for VAT in each EU member state can become admin heavy.

In this case, you can choose to use the One-Stop Shop (OSS) Union scheme, which means you still charge VAT at the rate of the country where you are selling, but you only have to report on one OSS VAT return.

Shopify allows you to set these tax settings for individual VAT registrations and automatically charge the correct taxes to your EU customers.

For further information on selling goods between EU member states, see: VAT guide for Shopify stores in the EU or read our blog post about the updated EU VAT rules.

To charge your customers abroad with the correct VAT rate, you need to set your tax settings accordingly. Shopify gives you the option to select OSS as your VAT registration type, allowing you to charge correct VAT rates automatically.

To set VAT rates for the OSS scheme and charge your customers' shipping country VAT rates on all orders:

- In your Shopify admin, go to the Settings → Taxes and duties page.

- In the Regional settings section, click on European Union.

- In the Collect VAT cross-border section, click on Collect VAT.

- In the Collect across the EU window, select the Collect using a One Stop Shop (OSS) registration option.

- Select your Country of OSS registration and enter your VAT number. Leave this field blank if you have applied for a VAT registration number but don't have one yet. You can update it later when you receive it.

- Save your changes by clicking on the Collect VAT button.

Now, your customers' shipping country VAT rates automatically apply to all EU sales.

Some businesses may decide to continue to hold tax registration for each EU country they ship to. If that is your case, in Shopify, you are able to add a local VAT registration number for a different country, which allows you to charge the correct VAT rates. Shopify will then automatically apply VAT rates based on your VAT registration.

To add the local VAT registration number:

- In your Shopify admin, go to the Settings → Taxes and duties page.

- In the Regional settings section, click on European Union.

- In the Collect VAT in an EU country section, click on Collect in another location.

- Select the Registration country and enter your VAT number. If you have applied for a VAT registration number but don't have one yet, leave this field blank. You can update it later when you receive it.

- Save your changes by clicking on the Collect VAT button.

- To add the local VAT registration number for every country you are registered in click, on the Collect VAT in an EU country option and confirm the selection by clicking on the Collect VAT button.

If you are not able to select the additional country you are VAT registered in, you may need to create a shipping zone first.

To create a shipping zone:

- In your Shopify admin, go to the Settings → Shipping and delivery page.

- In the Shipping section, click on the shipping profile that you want to add shipping zones to.

- In the Shipping zones section, click on Add shipping zone.

- Type in the name of the shipping zone, add the country (or countries) you are VAT-registered in using the search bar, and when finished, click on Done.

- To make this zone available, add the shipping rates.

- Click on Save to apply changes.

If you are selling goods from Latvia outside of the EU—whether B2B or B2C—these sales are exempt from VAT. This means that you do not charge VAT on your invoices.

Once you set your tax rates correctly in your store, Sufio will automatically create and send valid invoices with an exact breakdown of the VAT charged.

For personalised advice based on your specific business situation, consider consulting with a tax professional or accountant who specialises in VAT and ecommerce. You can do this by searching for a local tax advisor in your area.

Last updated on March 17, 2025.

Professional invoices for Shopify stores

Let Sufio automatically create and send beautiful invoices for every order in your store.

Install Sufio - Automatic Invoices from the Shopify App Store