In this article, you will learn how to configure taxes if your Shopify store is based in the European Union.

Caution

On January 1, 2025, new EU VAT regulations came into force. Among others, EU introduced a new Simplified VAT scheme for small and medium-sized enterprises (SMEs).

Under this new scheme, businesses with annual turnover below €100,000 across the EU may now qualify to be VAT-exempt. This is subject to national implementation of the EU legislation, so we recommend you consult your local tax authority.

We are currently updating this article to reflect the changes.

The most important distinction when it comes to charging VAT in your online store is whether your business is VAT-registered or not. This topic is further elaborated on in our Shopify VAT guide for selling to EU customers.

If your business is VAT-registered and you want to sell to both consumers (B2C) and business customers (B2B) in different countries of the European Union, you will need to set up your tax settings and tax rates correctly.

To charge VAT to some customers and not to others, Shopify allows you to choose from two possible configurations, based on how you want to display product prices on your online store.

If you are selling primarily to consumers (B2C) or the legislation in your country requires you to display tax-inclusive pricing, you can choose to have product prices as including VAT.

To display your prices including VAT, but still allow your business customers to have VAT deducted at checkout:

- In your Shopify admin, go to the Settings → Taxes and duties page.

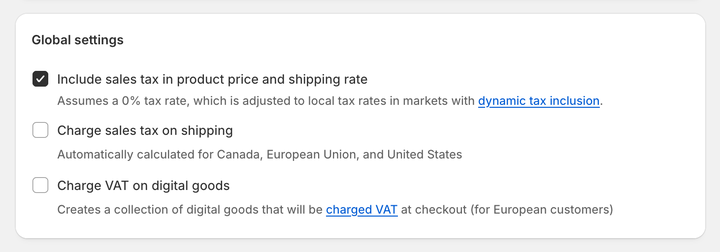

- In the Global settings section, check the Include sales tax in product price and shipping rate.

- Click on Save to apply the changes.

Optionally, you can enable dynamic tax inclusion. This Shopify feature automatically includes or excludes the tax based on the customer's region and adjusts the tax rate accordingly.

To activate dynamic tax inclusion:

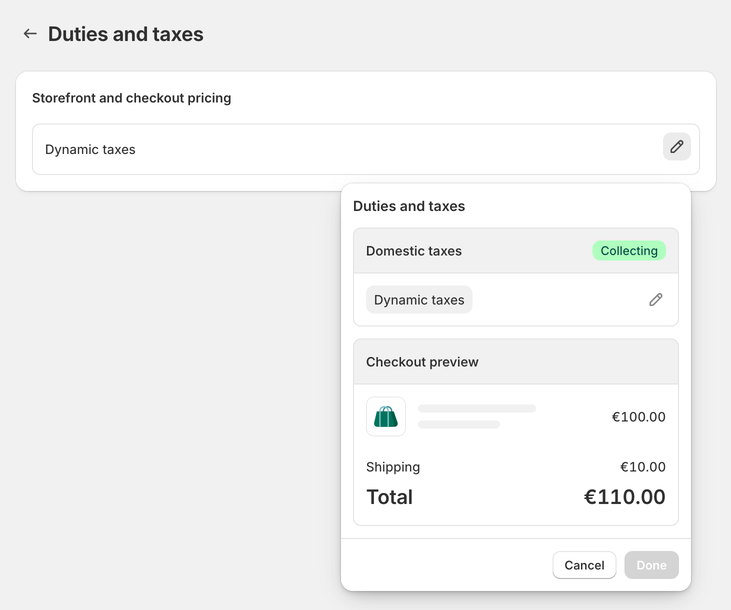

- In your Shopify admin, go to the Settings → Markets and click on the market for which you want to set up tax collection.

- Click on Duties and taxes and in the Storefront and checkout pricing field, click on Edit.

- In the Domestic taxes field, select the Dynamic taxes option. Click on Done.

- Click on Save to apply the changes.

In case your customers are predominantly businesses (B2B) you can choose to have your product prices displayed as excluding VAT.

To display your prices excluding VAT:

- In your Shopify admin, go to the Settings → Taxes and duties page.

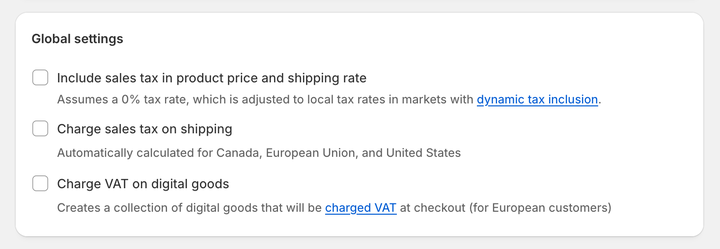

- In the Global settings section, uncheck the Include sales tax in product price and shipping rate.

- Click on Save to apply the changes.

Optionally, disable the dynamic tax inclusion:

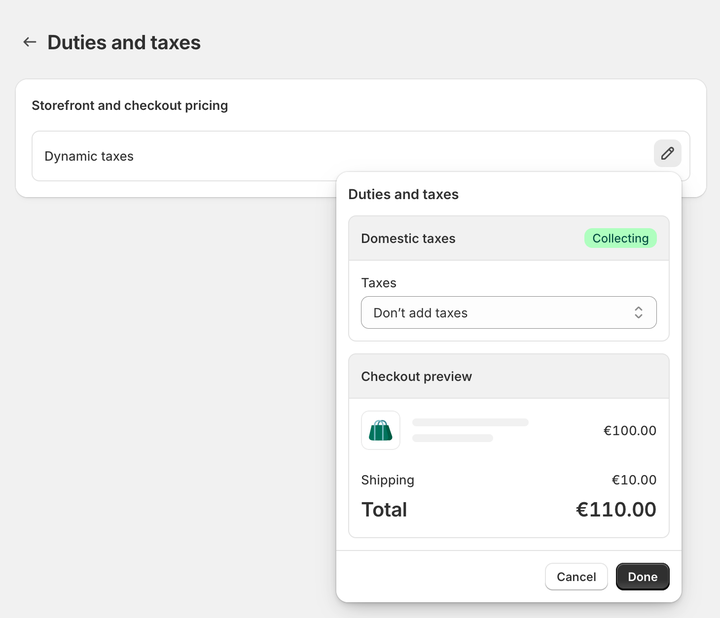

- In your Shopify admin, go to the Settings → Markets and click on the market for which you want to set up tax collection.

- Click on Duties and taxes and in the Storefront and checkout pricing field, click on Edit.

- In the Domestic taxes field, select the Don't add taxes option. Click on Done.

- Click on Save to apply the changes.

In the EU, you need to charge different tax rates depending on your taxable turnover on your online store. Shopify calculates the tax rate automatically based on the type of registration set in your tax settings.

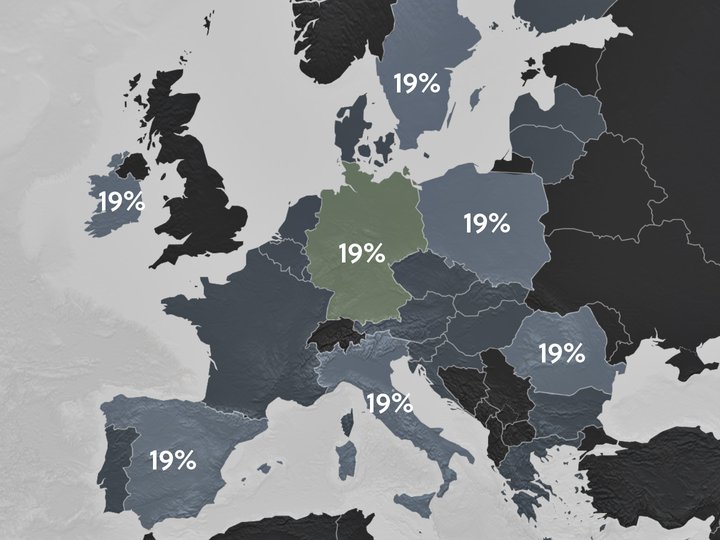

If you sell to customers in the European Union and your taxable turnover during a calendar year to all other EU countries combined does not exceed the threshold of €10,000 (excluding VAT), you qualify for the "micro-business" exemption. You should charge your home country's VAT rates on all the sales within the European Union.

To use the "micro-business" taxation scheme, you need to apply for the "micro-business" exemption at your local tax authority and have just one VAT registration within the European Union. Then, you can set up your tax settings in your Shopify admin. This task only needs to be performed once.

To set VAT rates for the "micro-business" exemption scheme and charge your home country's VAT rates on all orders:

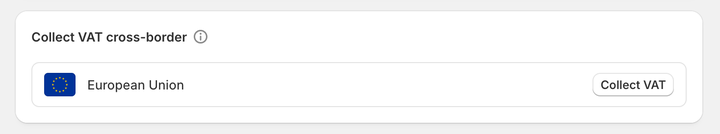

- In your Shopify admin, go to the Settings → Taxes and duties page.

- In the Regional settings section, click on European Union.

- In the Collect VAT cross-border section, click on Collect VAT.

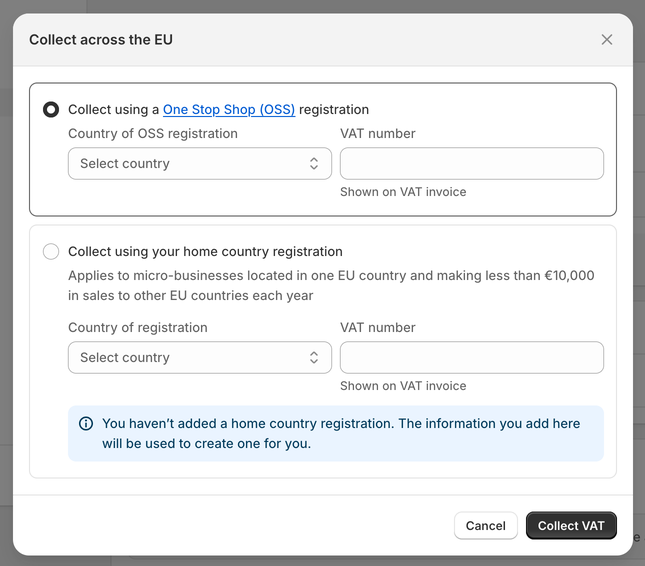

- In the Collect across the EU window, select the Collect using your home country registration option.

- Select your Country of registration and enter your VAT number. Leave this field blank if you have applied for a VAT registration number but don't have one yet. You can update it later when you receive it.

- Save your changes by clicking on the Collect VAT button.

Now, your home country's VAT rates automatically apply to all EU sales.

Surpassing the "micro-business" threshold

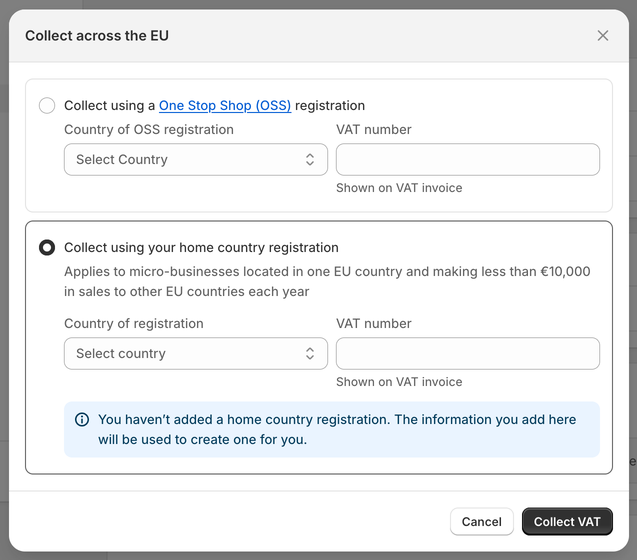

If you sell to customers in the European Union and your taxable turnover during a calendar year to all other EU countries combined is equal to or exceeds the threshold of €10,000 (excluding VAT), you should charge VAT at the rate applicable in the customer's shipping country.

This means that customers from different EU countries should be charged with different VAT rates, varying from 15% to 27%.

Suppose you have a business based in Germany. However, during a calendar year, you have surpassed the VAT threshold of €10,000 selling outside Germany to other EU countries. Because of that, you need to charge VAT at the rate applicable in the country you are shipping to.

Consequently, you have applied for the OSS (or One-Stop Shop) scheme, allowing you to sell outside your country and file a single VAT return. More importantly, the German VAT rate of 19% is now applied to Germany only. Customers outside Germany, within the European Union, are charged VAT at the rate applicable in their country.

In order to charge your EU customers with the correct VAT rate, you need to set your tax settings accordingly. Shopify gives you the option to select OSS as your VAT registration type, allowing you to charge correct VAT rates automatically.

To set VAT rates for the OSS scheme and charge your customers' shipping country VAT rates on all orders:

- In your Shopify admin, go to the Settings → Taxes and duties page.

- In the Regional settings section, click on European Union.

- In the Collect VAT cross-border section, click on Collect VAT.

- In the Collect across the EU window, select the Collect using a One Stop Shop (OSS) registration option.

- Select your Country of OSS registration and enter your VAT number. Leave this field blank if you have applied for a VAT registration number but don't have one yet. You can update it later when you receive it.

- Save your changes by clicking on the Collect VAT button.

Now, your customers' shipping country VAT rates automatically apply to all EU sales.

Caution

If you hold stock or have a physical location in a different EU country, you must register for VAT in that specific country and continue filing a local VAT return instead of the OSS. The One-Stop Shop (OSS) taxation scheme only applies to distance-selling.

Selling with a country-specific registration

Some businesses may decide to continue to hold tax registration for each EU country they ship to. If that is your case, you need to add the local VAT registration number for every country you are registered in. Shopify will then automatically apply VAT rates based on your VAT registration.

To add the local VAT registration number:

- In your Shopify admin, go to the Settings → Taxes and duties page.

- In the Regional settings section, click on European Union.

- In the Collect VAT in an EU country section, click on Collect in another location.

- Select the Registration country and enter your VAT number. If you have applied for a VAT registration number but don't have one yet, leave this field blank. You can update it later when you receive it.

- Save your changes by clicking on the Collect VAT button.

- To add the local VAT registration number for every country you are registered in click, on the Collect VAT in an EU country option and confirm the selection by clicking on the Collect VAT button.

In case you cannot select the additional country you are VAT-registered in, you will need to create a shipping zone for it first.

To create a shipping zone:

- In your Shopify admin, go to the Settings → Shipping and delivery page.

- In the Shipping section, click on the shipping profile that you want to add shipping zones to.

- In the Shipping zones section, click on Add shipping zone.

- Type in the name of the shipping zone, add the country (or countries) you are VAT-registered in using the search bar, and when finished, click on Done.

- To make this zone available, add the shipping rates.

- Click on Save to apply changes.

Note

If your Shopify store sells to both consumers and business customers, make sure your business customers are set as VAT-exempt in Shopify.

Caution

As of January 1, 2021, the UK is no longer part of the EU. Consequently, new regulations apply to direct sales between the UK and the European Union.

When selling to consumers (B2C) or businesses (B2B) from the EU directly to the UK, you must register for a UK VAT registration number, and the applicable VAT rate is based on the total value of the order. Orders worth less than £135 are subject to 20% VAT at the point of sale. Orders worth over £135 are subject to import VAT rules.

Get your free Shopify Tax Guide

Charging your customers the correct tax rates is essential for your business.

Get a free copy of our easy-to-read guide and kick off your sales!

Once your tax rates are set up correctly in your online store, Sufio will automatically create valid invoices with a detailed breakdown of the charged VAT.

Invoices can be created in multiple languages and include all the necessary details to make them compliant with the invoicing legislation in the EU.

Issuing invoices with the correct tax breakdown is essential for your bookkeeping and tax purposes.

If you are selling to businesses (B2B), Sufio invoices display all the required information including VAT identification numbers of your store and your business customers.

Invoices for Shopify stores in the EU

Let Sufio automatically send invoices and receipts for every order made in your store.

Get Sufio - Invoices for EU stores from the Shopify App Store