Setting up taxes correctly in your Shopify store is crucial for your customers to be charged the right amount of tax.

Once your taxes are set up correctly in your Shopify store, Sufio will use these tax settings and automatically display all the required tax details on your invoices.

What if, though, tax is missing in your orders and your invoices in Sufio? You do not need to worry. In this article, you'll learn about three possible causes as to why taxes are missing on your orders and invoices and how to fix them on your behalf.

Taxes are missing because:

It may happen that your store is not set to collect tax on the orders. For example, in the EU, you need to charge different tax rates depending on your taxable turnover on your online store. Shopify then calculates the tax rate automatically based on the type of registration set in your tax settings.

To configure tax rates in your Shopify store admin:

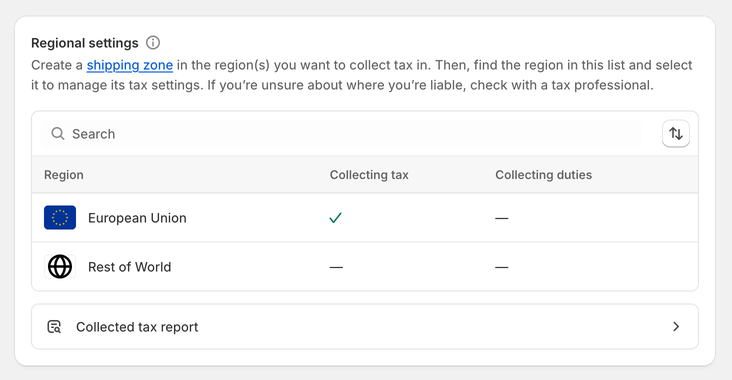

- In your Shopify admin, go to the Settings → Taxes and duties page.

- In the Regional settings section, set up the tax collections based on the type of tax registration of your business and the country you're VAT-registered in.

If you do not see the country in the Regions list, you will need to create a shipping zone first. To create a shipping zone:

- In your Shopify admin, go to the Settings → Shipping and delivery page.

- In the Shipping section, click the shipping profile that you want to add shipping zones to.

- In the Shipping zones section, click Add shipping zone.

- Type in the name of the shipping zone, add the country (or countries) you are VAT-registered in using the search bar, and when finished, click Done.

- To make this zone available, add the shipping rates.

- Click Save to apply changes.

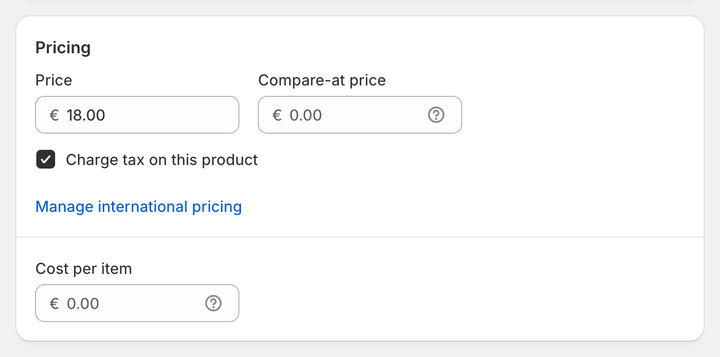

If you want to charge tax on your products, every product in your Shopify store has to be set as taxable.

To set up a product as taxable:

- In your Shopify admin, go to the Products page.

- Click on the product you want to edit.

- Scroll down to the Pricing section and check the Charge tax on this product checkbox.

- Click Save to apply the changes.

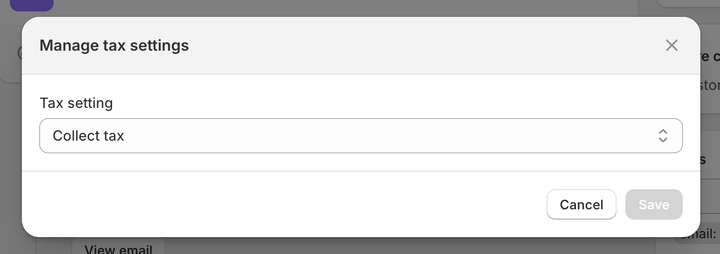

Sometimes, it might happen that a customer was set as tax-exempt, although they should not have been. As a result, this customer is exempt from paying taxes on all their orders.

To check if a customer is set up tax-exempt:

- In your Shopify admin, go to the Customers page.

- Select the customer you need.

- In the Tax settings section, click Manage, and make surein the Tax settings dropdown, the Collect tax checkbox is selected.

- Click Save to apply your changes.

Caution

Any changes you make to your tax settings in the Shopify admin will only affect newly created orders and invoices. Existing invoices will remain unaffected.

Professional invoices for Shopify stores

Let Sufio automatically create and send beautiful invoices for every order in your store.

Install Sufio - Automatic Invoices from the Shopify App Store