Once you've set up taxes correctly in your Shopify store, you will need to decide whether you want your product prices to include or exclude tax.

To include or exclude tax from product prices:

- In your Shopify admin, go to the Settings → Taxes and duties page.

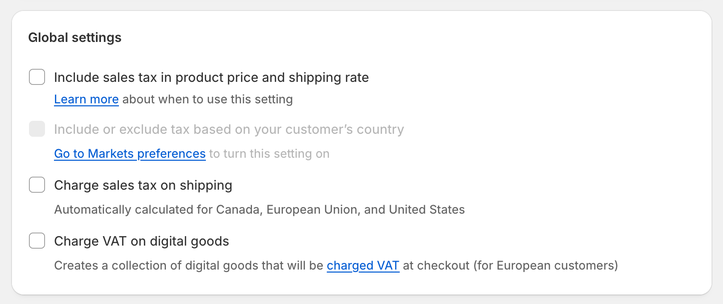

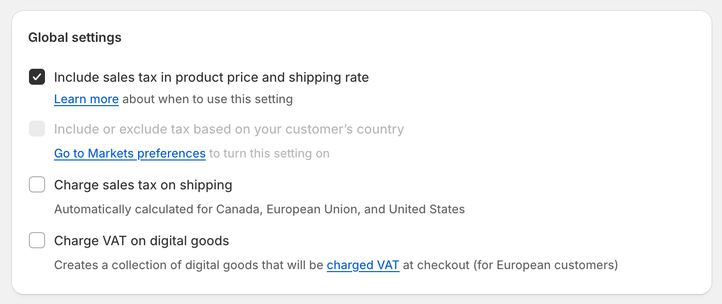

- Scroll down to the Global settings section.

- To exclude tax from your product prices, uncheck the Include sales tax in product price and shipping rate checkbox.

- To include tax in product prices, check the Include sales tax in product price and shipping rate checkbox.

- Click Save to apply your changes.

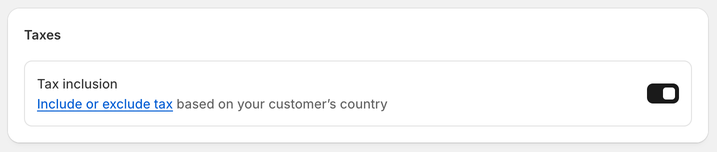

Optional: If you want to include or exclude tax based on the country your customer is shopping from:

- In your Shopify admin, go to the Settings → Markets page.

- In the top-right corner of the page, click Preferences.

- Turn the toggle next to Include or exclude tax based on your customer’s country on.

Suppose a Shopify store based in France is selling a product for the price of €20. The store should charge 20% tax to customers in France and 0% tax to customers in the US.

The table below shows how much the customer from France and the US will eventually pay at checkout based on your tax settings.

| Customer in France pays | Customer in the US pays | |

|---|---|---|

| Prices exclude tax | €24 (€20 + €4 tax) | €20 (no tax) |

| Prices include tax | €20 (€16.67 + €3.33 tax) | €20 (no tax) |

| Prices include or exclude tax based on the customer's country | €20 (€16.67 + €3.33 tax) | €16.67 (no tax) |

In case the product prices exclude tax, the customer from France pays €24 in total, which is €20 for the product, and €4 tax. The customer from the US only pays €20 for the product, without tax.

This is in line with accounting legislation in many countries where VAT or GST is charged and allows you to charge tax to some customers but not to others.

Using this setting, you can charge tax to consumers, but VAT-exempt your business customers in the European Union or not charge tax on certain products for customers with a disability or indigenous people.

Having tax excluded from product prices means that your Shopify store will display them without tax. This is useful if you predominantly sell to businesses.

If your product prices include tax, both French and US customers will pay the same price of €20.

The customer from France pays €16.67 for the product and €3.33 tax, whereas the US customer pays €20 for the product. This means that the US customer pays more for the same product than the French one.

The advantage of having prices include tax is that all customers will see the final price, which is especially useful when selling primarily to consumers or the legislation in your country requires you to display tax-inclusive pricing.

However, this setup is not suitable for online stores that need to VAT-exempt customers, such as businesses.

When product prices include or exclude tax based on the customer's country, the customer from France pays €16.67 for the product plus €3.33 tax, and the customer from the US pays only €16.67 for the product.

This option prevents some customers from paying non-applicable tax and allows your Shopify store to automatically calculate and selectively charge tax based on where your customer is shopping.

More importantly, this setup allows you to display prices with taxes and still VAT-exempt some customers such as businesses, or not charge tax on products for customers with a disability or indigenous people.

Caution

Any changes you make to your tax settings in the Shopify admin will only affect newly created orders and invoices. Existing invoices will remain unaffected.

Professional invoices for Shopify stores

Let Sufio automatically create and send beautiful invoices for every order in your store.

Install Sufio - Automatic Invoices from the Shopify App Store