If your business is VAT registered and based in the EU, you're most likely familiar with the VAT exemption requirements that you need to apply to your EU business customers.

Sufio makes it easy—allowing you to capture and validate EU VAT registration numbers from your business customers on your Shopify store and, when applicable, automatically set them as tax-exempt.

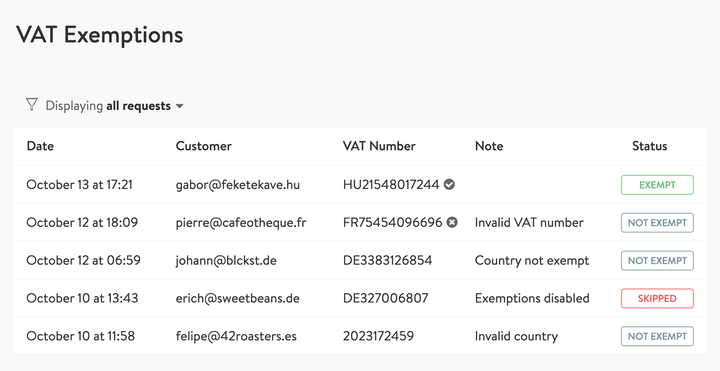

The View VAT Exemptions page can be used to review and troubleshoot VAT exemption requests made on your online store. It lists all successful, as well as unsuccessful exemption requests, and allows you to filter them by their status.

To access the View VAT Exemptions page:

- In your Sufio account, go to the Settings → Taxes page.

- Click on View VAT Exemptions.

In this article, we'll guide you through, as well as help you troubleshoot any errors that may occur. We'll discuss:

- What do different statuses of VAT exemption requests mean?

- How to troubleshoot unsuccessful VAT exemptions requests?

There are a few statuses that provide you with useful information and specify what the final result of the tax-exemption request was.

When Sufio sets your customer as tax-exempt successfully, the Exempt status appears.

Your customer is set as tax-exempt either after inserting a valid VAT number or by marking him as tax-exempt in your Shopify admin manually. The Exempt status also appears for customers that were previously set as tax-exempt (both manually or by previous successful exemption requests).

The Not exempt status tells us that some conditions, necessary to tax-exempt a customer, have not been met. The available notes will help you to learn more and understand the case entirely.

Notes for the Not Exempt status

| Note | Description |

|---|---|

| Invalid country | The customer’s country is not valid. This means that the VAT number is not prefixed by a correct two-letter country code of the EU country. |

| Country not exempt | Customers from this country should not be tax-exempt. In most cases, this means that the customer is based in the same country as your Shopify store. These customers should not be tax-exempt—When selling to consumers (B2C) and businesses (B2B) in your home country, you should always charge VAT. It may also mean that the country of the provided VAT number does not match the customer's shipping country. |

| Invalid VAT number | The provided VAT number is not valid. The number was not in a valid format, or the EU VIES VAT number validation service did not validate it. |

| Account country | Tax exemptions are not available for your country. Make sure you have set your Company’s country to an EU country. To do that, in your Sufio account, go to the Settings → Company Profile page. |

| Unable to process | Unable to process the exemption request. There was a technical problem with processing the request. |

If Sufio marks a VAT exemption request as Skipped, it means that there was a piece of information missing in order to successfully perform the request. Or, it may also mean that your settings are not set properly. To fully comprehend the status, always look at the Note column, which contains the needed explanation.

Notes for the Skipped status

| Note | Description |

|---|---|

| No email | No email address was provided by this customer. |

| No VAT number | No VAT number has been provided by this customer. |

| Customer not found | The customer with a given email address has not been found in your online store. |

| Exemptions disabled | VAT exemptions are not enabled in your Sufio account.

To fix that, in your Sufio account, go to the Settings → Taxes page, and enable the EU VAT Exemption feature. |

| Validation unavailable | Despite multiple attempts, the EU VIES service was not available to validate the VAT number. |

Setting up the EU VAT exemptions correctly for your Shopify store is crucial in order to charge the right taxes to your business customers. However, it might happen that the tax-exemption request has not been successful. There are three possible causes as to why that happened:

- EU VAT Exemptions are disabled

- Missing or no exemption requests available

- Customers who are tax-exempt in Shopify, still get charged VAT

The most frequent reason why Sufio does not process the exemption request successfully is that the EU VAT Exemptions feature is not enabled; consequently, the request is marked as Skipped.

To enable the EU VAT Exemptions feature:

- In your Sufio account, go to the Settings → Taxes page.

- Turn the Enable EU VAT Exemptions toggle on.

- Save your changes by clicking on Update Settings.

Additionally, users on Standard or higher plans can have Sufio validate the VAT registration numbers through the EU VIES number validation service. To set this, make sure you have the Validate VAT Numbers feature enabled:

- In your Sufio account, go to the Settings → Taxes page.

- Turn the Validate VAT Numbers toggle on.

- Save your changes by clicking on Update Settings.

If you do not see any or just some exemption requests on your VAT Exemptions page, it might be that the code snippet capturing VAT numbers on your Shopify store and calling the exemption request is not inserted correctly or is in conflict with another Shopify app you’re using.

Need help?

This troubleshooting requires some coding knowledge. Do you need any assistance? Please, get in touch with our experienced support team. We’ll be pleased to assist.

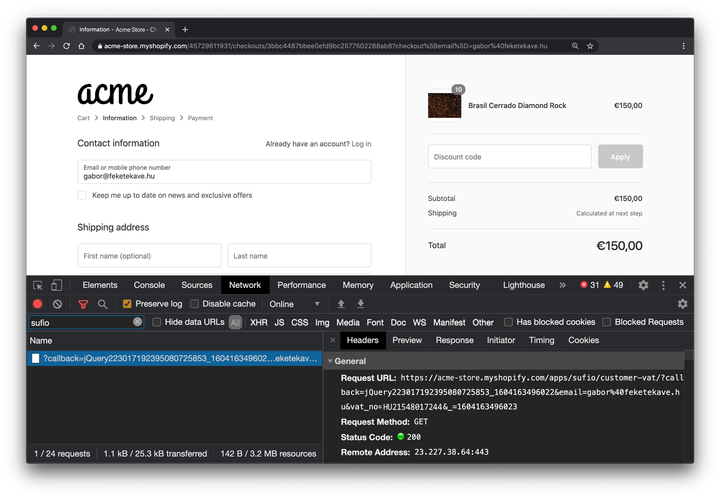

To get more insight, please follow these simple steps:

If using Chrome:

- Open your Shopify store page.

- Open the Inspect tool (right-click → Inspect)

- Navigate to the Network tab and make sure you have Preserve log checked.

- Enter a valid VAT number in one of the VAT number input fields and proceed.

- Search the list of recorded network calls for

sufioto see if your code snippet is calling our service correctly.

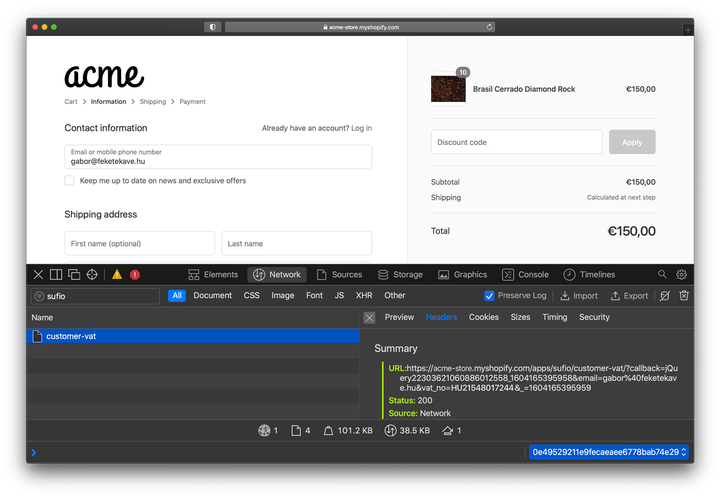

If using Safari:

- Open your Shopify store page.

- Inspect the element (right-click → Inspect the element)

- Navigate to Network tab and make sure you have Preserve log checked.

- Enter a valid VAT number in one of the VAT number input fields and proceed.

- Search the list of recorded network calls for

sufioto see if your code snippet is calling our service correctly.

If the call has been given the status cancelled, it may be that the code snippet is not inserted accurately. We recommend having a look at it, making sure all the necessary steps when updating the store theme have been followed.

Need help?

Do you need help with customizing your Shopify store theme? Please contact our experienced support team. We'll be happy to assist!

If you have your business customers set as tax-exempt in your Shopify store, but they still get taxes charged on their orders, your tax calculations are most likely not set well.

To make tax-exemptions work, you need to set up EU taxes in your Shopify store correctly.

Invoices for Shopify stores in the EU

Let Sufio automatically send invoices and receipts for every order made in your store.

Get Sufio - Invoices for EU stores from the Shopify App Store