How to Set Payment Terms on Your Shopify Invoices

In the competitive world of ecommerce, clarity and professionalism are key to building trust with your customers.

Business owners typically do this by securing their stores with SSL certificates, using reputable payment processors like PayPal and Stripe, and making sure they comply with relevant data protection laws like the EU’s GDPR and the UK's Data Protection Act.

There’s just one aspect that’s often overlooked: the humble invoice.

A well-crafted invoice with clear payment terms can significantly improve your customers’ experience and expedite your payment process.

Today, we’ll guide you through writing effective payment terms for your Shopify invoices.

Why clear payment terms matter

Clear payment terms set expectations and prevent confusion and misunderstandings. They help your customers understand when and how to pay, reducing the likelihood of late payments in the future.

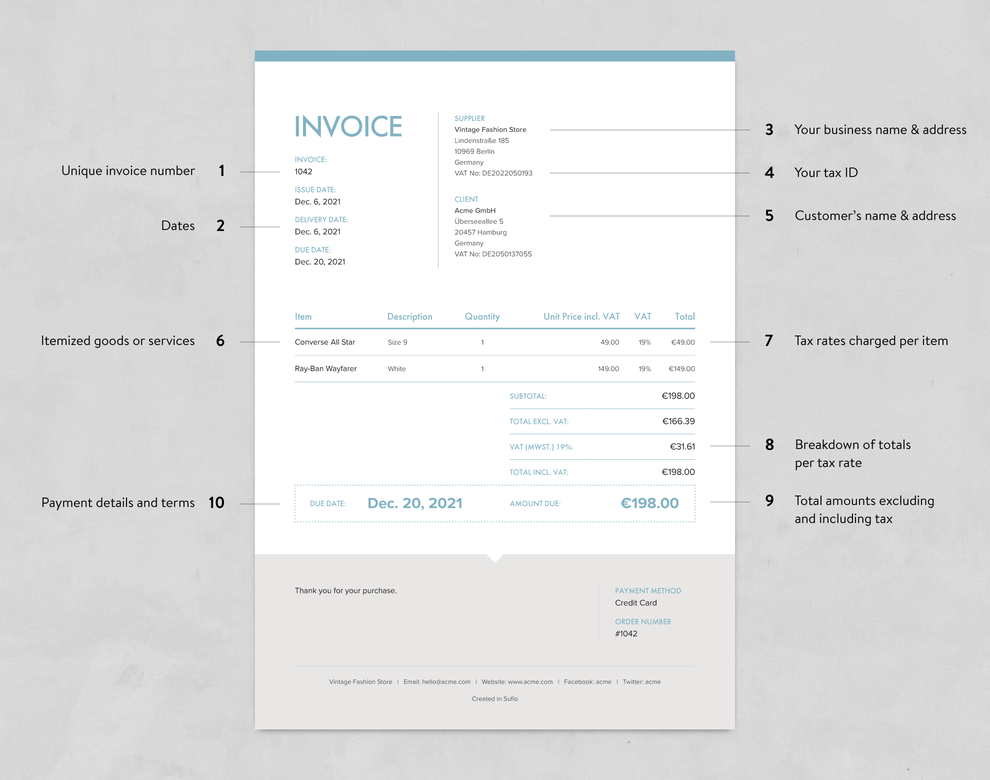

What to include in your payment terms

Here are some key elements you might want to include in your Shopify invoice payment terms:

1. Payment due date

Clearly state when the payment is due. This could be a specific date, or a period after the invoice date, such as "Net 30" (payment due within 30 days).

2. Accepted payment methods

Specify the payment methods your shop accepts. This could include credit/debit cards, PayPal, bank transfers, or even cryptocurrency.

3. Payment instructions

Provide step-by-step instructions on how to make a payment. For example, if you accept bank transfers, include your bank details so customers can copy and paste the IBAN.

4. Late payment fees

If you charge late fees, make sure to mention this. You might also want to include the percentage or fixed amount that will be added.

5. Discounts for early payment

If you offer discounts for early payments, be sure to highlight this. It can encourage B2B customers to pay sooner.

6. Return policy

Briefly outline your return policy and how it affects the invoice. This could include details about refunds or Shopify credit notes.

7. Contact information

Provide an email address that customers can use to contact you if they have any queries about the invoice.

How to set payment terms on Shopify invoices

If you’re running an online store on Shopify, Sufio will automatically include basic payment terms on your invoices. These are defined by the Shopify order, so values like payment method, due date, and net terms are populated with data from the order itself.

If you’re creating (or editing) your invoices manually, you can include custom payment terms using the fields for:

- Payment method: Includes popular options like bank transfer, credit card, cash on delivery, and more.

- Due date: The payment deadline (usually 14 days after the issue date)

- Contact details: Provide your customers with an email address and phone number they can use to contact you

- Notes: An empty field you can use to add anything else: late payment fees info, a mini return policy, detailed payment instructions, etc.

Tip

Use Sufio in tandem with Shopify payment terms to dictate how much time customers have to pay for their order and have that information display on your Shopify invoices automatically.

Tips for writing effective payment terms

If you're going to use the Notes field to write out payment terms yourself, be sure to:

- Be clear and concise: Use simple, straightforward language. Avoid jargon.

- Be polite: Maintain a friendly and professional tone.

- Localize: If you sell internationally, consider translating your payment terms into your customers' languages.

How to automate your invoicing on Shopify

The Shopify App Store offers many invoicing apps, but only one that’s trusted by over 6,000 successful merchants, including world-renowned brands like Herman Miller and Zippo.

With Sufio, you can join them and…

- Create and send invoices for every Shopify order automatically.

- Automatically create credit notes from refunds

- Send invoices compliant in over 50+ and translated into over 35 languages

- Choose one of our professionally designed invoice templates for Shopify and customize it by adding your brand’s logo and colors

- Let the app send reminders for overdue invoices

- Export multiple invoices in bulk and send the data to your accountant

Conclusion

Writing clear payment terms on your Shopify invoices is a small but powerful way to improve your customers’ experience and streamline your payment process.

By following the tips we shared in this article, you can create professional invoices that drive results (and help you get paid faster).

Ready to take your invoicing to the next level? Try Sufio today and experience the power of automated invoicing.

Professional invoices for Shopify stores

Let Sufio automatically create and send beautiful invoices for every order in your store.

Install Sufio - Automatic Invoices from the Shopify App Store