US Tariffs and De Minimis: What Shopify Merchants Need to Know

The recent tariffs and trade policies introduced by the Trump administration are poised to shake up the ecommerce world, especially for ecommerce businesses selling to US customers.

Alongside these new tariffs, the elimination of certain de minimis exemptions will add complexity to international shipping, pricing, and customer satisfaction.

For Shopify stores—particularly those sourcing goods from China and Hong Kong—these changes demand attention to stay compliant and keep your business running smoothly.

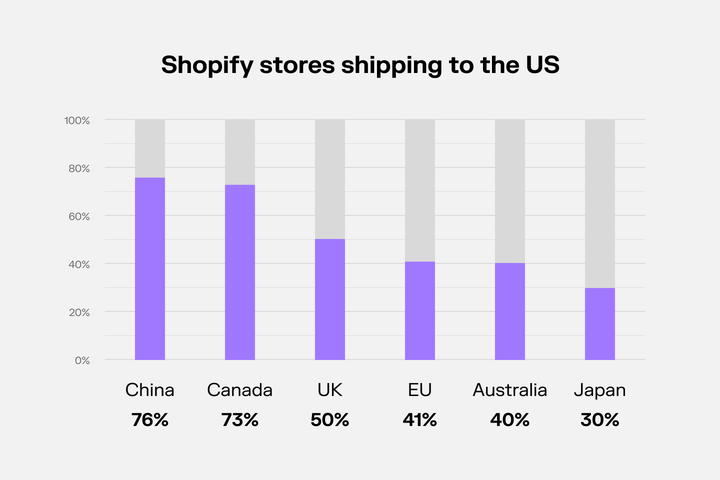

To put this into perspective, let’s look at the global scale of Shopify’s reach:

73% of Shopify stores in Canada and 76% in China offer shipping to the US. In the UK, that figure is 50%, while 41% of EU stores and 40% in Australia also target American buyers.

Even in Japan, where the percentage dips to 30%, the impact remains significant. These numbers underscore just how many merchants worldwide could feel the ripple effects of these policies.

In this blog post, we’ll dive into the key updates: the elimination of de minimis exemptions for goods from China and Hong Kong, the new tariffs on international sales to the US, and what these changes mean for your Shopify store.

We’ll also share actionable steps to keep your business compliant and your customers happy—all while spotlighting how tools like Sufio, a powerful invoicing solution for Shopify, can help you navigate this shifting landscape.

Elimination of de minimis exemptions for sales of goods originating in China

The de minimis provision has been a lifeline for ecommerce, letting imports valued at $800 or less enter the US duty-free. It’s been a game-changer for platforms shipping directly to consumers without the burden of tariffs.

But come May 2, 2025, an executive order signed by President Donald Trump will scrap this exemption for goods originating from China and Hong Kong.

This move zeroes in on Chinese giants like Shein and Temu, which have leaned on de minimis to keep prices low. But it’s not just the big players—Shopify merchants, especially those dropshipping from China, will feel the heat too.

The key detail: it’s all about the country of origin, not where your goods ship from.

So, if your products were made in China or Hong Kong, they’re in the crosshairs—even if they’re dispatched from a warehouse in, say, Vietnam or the UK.

For Shopify merchants, this means you need to pinpoint the country of origin for every product in your catalog. Declaring this—along with each item’s value—on documents like commercial invoices is essential.

Customs authorities rely on this transparency to calculate duties and import taxes accurately, so getting it right keeps shipments moving and customers happy.

Tip

A heads-up: The Trump administration’s policies can shift fast. There’s already chatter about further tweaks to de minimis rules, possibly targeting specific product categories. If you sell internationally, keeping an eye on these developments is a smart move to avoid getting caught off guard.

New tariffs for international sales to the US

On top of the de minimis shake-up, new tariffs are hitting imports to the US. Early proposals floated rates from 10% to 50% depending on the country of origin, but they’ve settled at 10% for most countries—except China, whose tariffs Trump raised to a staggering 145%.

These tariffs pile onto regular customs duties and cover nearly all product categories, sparing only a few like raw materials, pharmaceuticals, and semiconductors.

For Shopify stores selling goods originating from countries other than China or Hong Kong, duties only apply to shipments to the US exceeding the $800 de minimis threshold.

And here’s the fine print: that $800 limit applies to the total value of all goods in a single shipment to one customer.

So, let’s say a customer orders three items worth $300 each, totaling $900. The whole shipment gets hit with tariffs, even though each item falls under $800 individually. Knowing this helps you plan shipments and set customer expectations.

Who pays these duties?

In brick-and-mortar retail, importers typically absorb duties and bake them into prices. But in ecommerce, where you’re selling directly to customers, it’s usually the buyer who pays duties and import taxes.

As a Shopify merchant shipping internationally, you’ve got two main options—or Incoterms—to decide who pays and when:

- DDU (Delivered Duty Unpaid), aka Delivered at Place (DAP): Your customer settles duties and fees when the package arrives, often via the carrier or customs agency. It’s simple for you—ship and done—but it can leave customers blindsided by extra costs and delays, risking frustration.

DDP (Delivered Duty Paid): You calculate duties and taxes upfront, folding them into the checkout price. Customers pay everything at once, enjoying a seamless delivery with no surprises. It’s a win for transparency, but it requires more effort on your part.

Not all shipping carriers support DDP, though major ones like DHL, UPS, and FedEx offer it for many destinations.

Shopify also has its limits—for instance, DDP isn’t available with Shopify Shipping or the Shopify Fulfillment Network. Additionally, Shopify can’t automatically calculate duties at checkout if you’re using location-based taxes in your store; it only works with registration-based tax settings.

Picking between DDU and DDP Incoterms hinges on your priorities. Want to keep things easy? DDU’s your pick. Value a polished customer experience? DDP’s worth the extra work.

What do you need to do as a merchant?

Whether you offer DDU or DDP, these changes call for action. Here’s your to-do list to stay ahead:

Assign the right country of origin and HS codes to your products:

The country or region of origin (COO) is where a product was created or assembled into the form in which you sell it.HS (Harmonized System) codes are six-digit codes that classify goods for trade—think of them as a global product category or group ID.

In the Shopify admin, you can add these to a single product on the product page, update multiple products with the bulk editor, or upload them using a CSV file. Tools like Shopify Managed Markets can auto-assign HS codes, but you’ll still need to handle COO manually.

Update shipping policies and checkout: Clearly state whether duties and import taxes are included in the final price paid at checkout (DDP) or not (DDU). If they were not included, inform customers about potential duties and fees to reduce the risk of refund requests or negative reviews.

- Split shipments strategically: Where practical, ship products originating from countries with de minimis exemptions separately from those without, and keep shipments to the US under $800 to avoid tariffs.

- Revisit your pricing: Higher import costs might mean tweaking prices. Resellers could explore sourcing from lower-tariff countries to stay competitive.

- Ensure accurate documentation: A solid commercial invoice prevents delays and disputes—more on that next.

The importance of professional commercial invoices

Customs authorities lean on commercial invoices to figure out a shipment’s value and calculate duties and import taxes.

For DDP shipments, they also verify that the pre-paid fees match the declared values.

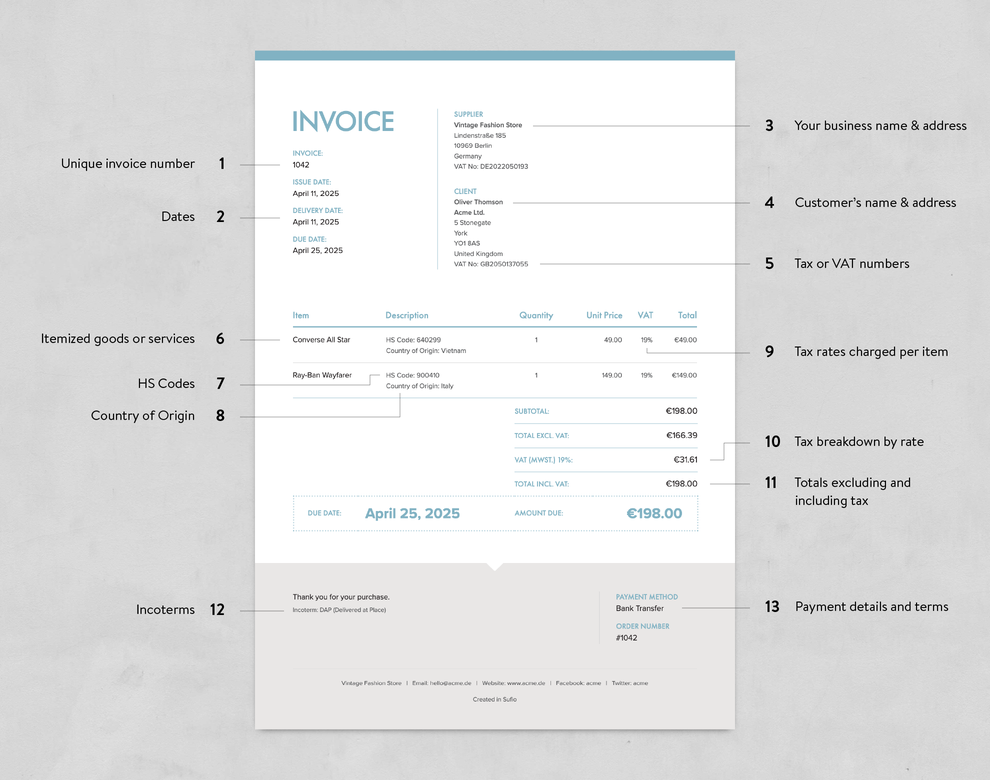

A commercial invoice covers everything found in a standard tax invoice, like seller and buyer details, product descriptions, quantities, tax amounts, and unit and total prices.

It also requires extra information, including HS codes, the country of origin for the goods, and Incoterms (such as DDU or DDP).

Most carrier companies can generate basic commercial invoices from your shipment data, but using an app like Sufio elevates the process significantly:

- Consistency across all documents: Your commercial invoices will feature consistent, essential details—such as unique tax numbers for you and your customer—matching the invoices sent to your customers via email or used for accounting. This enhances professionalism and minimizes confusion.

- Compliance with local regulation: Various countries have distinct invoicing regulations, with increasing mandates for e-invoicing in many regions. By creating your own invoices, you can ensure compliance with legal standards in both your country and your customer’s, lowering the risk of customs delays or tax issues.

- Strengthening your brand: Custom commercial invoices let you showcase your branding—logo, colors, and typography—while aligning them with your website and product packaging. This builds customer trust and reinforces your brand identity at every touchpoint.

Conclusion

Trump’s tariffs and the de minimis overhaul are rewriting the rules for Shopify merchants selling to the US. By getting a handle on these changes—assigning accurate COO and HS codes, picking the right Incoterms, and leaning on professional invoices—you can keep your store compliant and your customers smiling.

In this fast-moving trade climate, staying sharp and adaptable is everything. With smart strategies and tools like Sufio, you can turn these challenges into a chance to outperform competitors and grow your business.

Professional invoices for Shopify stores

Let Sufio automatically create and send beautiful invoices for every order in your store.

Install Sufio - Automatic Invoices from the Shopify App Store