A commercial invoice is a customs document that enables goods to be shipped by a person or business across international borders.

Commercial invoices help shipments move seamlessly through the international delivery network and enable customs authorities to obtain a complete picture of what a delivery contains and the taxes or duties that may be associated.

A commercial invoice itemizes and records the actual transaction between seller and buyer. When correctly completed, it helps guard against delayed delivery, extra charges, and a poor customs experience for both parties.

A commercial invoice needs to provide a good deal of information, clearly and compliantly for goods to move across customs borders without delay. Accuracy is paramount—whoever completes the commercial invoice will be liable for its contents, and any incorrect or misleading information could cause a security or customs breach.

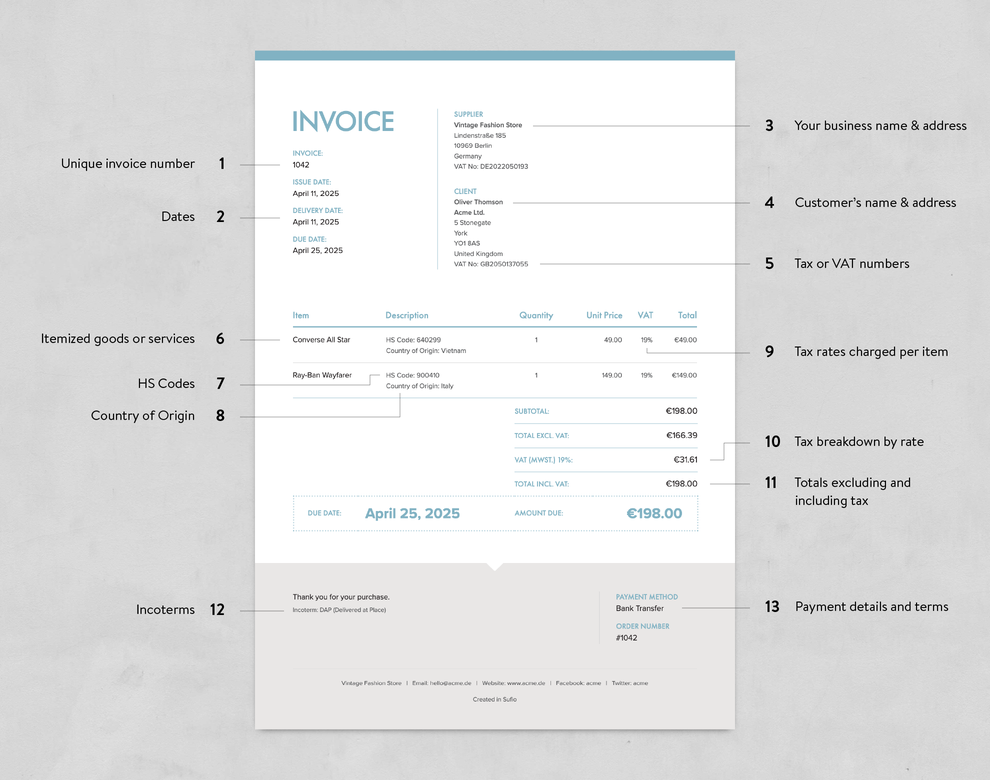

Let’s take a look at what a well-designed commercial invoice should include:

Unique invoice number

This is a unique number that helps to identify the invoice within your own accounting system. You can also use it to track payments made by requesting that this number be used to identify any associated transactions.

Dates

Time stamping a transaction is a key function of an invoice, so including dates is essential. You should include the date of issue and the date of supply (sometimes referred to as “tax point”) if this differs from the date of issue. You might also wish to include the date at which payment is due.

Your business name & address

This section should include everything needed to identify and contact the one sending the invoice. Make sure your company name, address, and contact information are clearly stated. Consider the different ways a customer may like to get in touch and provide a few options.

Customer’s name and address

A commercial invoice must also state who is responsible for the associated payment. Include the client or customer name, address, and relevant contact information.

Tax or VAT numbers

You need to include information that can identify both your business and the business of your customer for tax purposes. Depending on your location, this might be a value-added tax (VAT) or goods and services tax (GST) number, for example.

Itemized goods or services

Your invoice should clearly show what was purchased and in what quantity. As a result, be sure to itemize your product list across separated lines, giving clear unit prices.

HS codes

You should include Harmonized System (HS) codes, which are part of a system developed by the World Customs Organization to describe the types of goods shipped. Using HS codes can help your exports make it through customs faster.

Country of origin

A commercial invoice should include the country or region of origin (COO) for each product, which refers to where the product was manufactured or assembled into its final form for sale.

Tax rates charged per item

Different items may be subject to different tax rates, and your invoice must reflect this. Be sure to outline tax rates charged per item for total clarity. By itemizing your invoice, you’ll be able to clearly show where certain items may be exempt or subject to different rates.

Tax breakdown by rate

Along with the tax rates, your invoice should clearly display the total tax amount charged for each rate.

Totals excluding and including tax

In addition to itemized pricing, your invoice must include a clear invoice total. This should show both the total amount excluding tax and the total including tax.

Incoterms

12.Incoterms, or international commercial terms, define who is responsible for paying any applicable duties and import taxes. Include the agreed term—such as DDP (seller pays duties) or DDU/DAP (buyer pays duties)—on your commercial invoice.

Payment details and terms

You should clearly state the payment method on the invoice—such as credit card or bank transfer—and include bank account details if payment is made by transfer. You can also display the Order Number or Purchase Order (PO) number for reference.

An outstanding invoice does more than simply provide the necessary record of a transaction; it also represents an essential touchpoint with your customers.

Whenever payments are involved, as a business, we want to do all we can to ensure that trust is high. And providing a generic, unbranded invoice does not convey a strong enough sense of this to your customer.

Are you looking to create a unique and impactful ecommerce brand experience? Let’s have a chat!

We're eager to listen to your ideas and assist you in tailoring your Sufio account to align with your brand's specific requirements.

Book a free callAn invoice is a real opportunity to give an impression of your brand. By paying attention to the design of your invoice, you can keep things consistent and build trust. In doing this, your invoicing becomes a positive part of your customer relationship and not just a financial necessity.

Professional invoices for online stores

Let Sufio automatically create and send beautiful invoices for every order in your store.