As an ecommerce seller, you may sometimes find that you receive a big order or a custom request from a buyer that may cost you more to meet than initially planned.

In this situation, you can issue your customer with a ‘draft’ invoice, a document that makes clear that your prices may change once the item is ready for shipping. This is called a pro forma invoice.

You can send a pro forma invoice to your customer before you have an exact understanding of all of the labour, materials and time needed to meet the customer’s order in full.

It’s important to note that a pro forma invoice is not a legally binding document. Unlike a standard sales invoice, VAT invoice or quotation, a seller is not obliged to sell at the prices stated outlined in a pro forma invoice.

As an ecommerce seller, you should not record the pro forma invoice in your bookkeeping or accounting software as a sale, as you have not yet issued a standard sales invoice.

At the same time, your customer should not make payments against a pro forma invoice, as they won’t be able to properly record the payment as a business purchase. Neither can they reclaim VAT or sales tax against this expense.

There are a couple of scenarios in which you as the seller may find it helpful to issue a pro forma invoice.

Firstly, you may want to issue a pro forma if the product or service that the customer has requested is a bespoke item or is manufactured on a one-off basis. It may be that a specific item requires a lot of extra work or is very time-consuming.

Sending a pro forma invoice allows you the seller to give your customer a general picture of the costs involved for them, while helping them understand that the final amount you charge may change due to differing costs on your side.

Secondly, pro forma invoices are commonly used when selling to overseas customers and can be used by the customer as a guide for the shipping costs they can expect to pay. In this situation a pro forma invoice would include details about packaging, the expected weight of the items and the delivery costs.

Thirdly, for larger orders for international customers, pro forma invoices can be used by the seller to get import letters of credit. These are promises of future payment to the seller from the buyer’s bank and are sometimes useful documents for exporters.

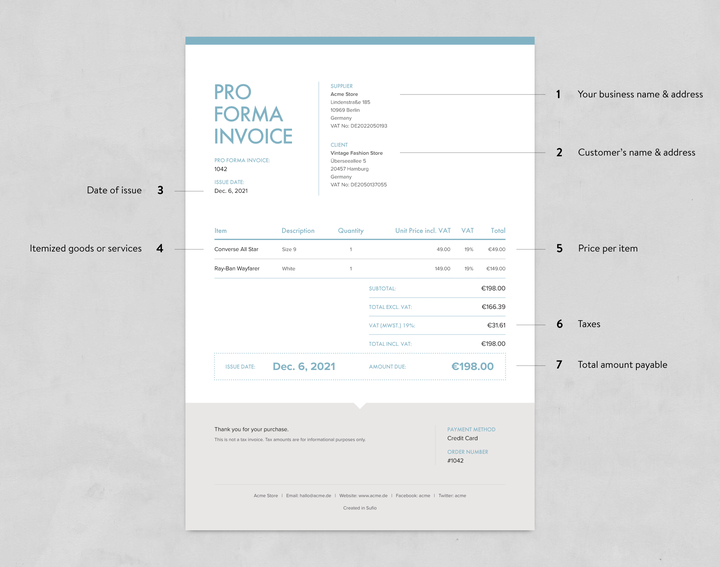

To make things easy, it’s best to put together a pro forma invoice in a similar way to a standard sales invoice, but with a couple of differences. The document should include:

- Your business name & address

- Customer’s name & address

- Date of issue

- Itemized goods or services

- Price per item

- Taxes

- Total amount payable

It should be made clear, usually at the top of the document, that it is a pro forma invoice and not a full sales invoice.

As a pro forma invoice isn’t an official legal document, it doesn’t really need to be cancelled if the you discover that the final cost of delivering a product or service is different from the amount quoted in the pro forma.

Once you’ve worked out final costs, you can “convert” the pro forma into a standard sales invoice and send this new document to the customer. The prices outlined in this fresh invoice are binding on the buyer.

Sufio can help with all this by giving you access to professionally-designed invoice templates and the ability to create and send documents automatically! Head over to our homepage for your 14-day free trial today.

Professional invoices for online stores

Let Sufio automatically create and send beautiful invoices for every order in your store.