How to get your Shopify store ready for Brexit

Britain was scheduled to leave the European Union at the end of March, yet the fate of Brexit remains in flux.

If you have a Shopify store in the UK or an EU country, you are probably wondering what the UK’s imminent withdrawal means for your store and your customers on both sides of the English Channel.

In this article we will go over the two possible Brexit scenarios, and what you need to do as a Shopify store owner to stay legally compliant in each case.

What’s happening with Brexit?

Well, it’s all a bit of a mess and something British politicians have been arguing over for nearly three years after the UK voted to leave the EU in June 2016.

The original departure date was set for March 29, 2019, but the EU agreed to postpone the Brexit date after the British Parliament failed to get the deal approved.

The “divorce” deal, known as the Withdrawal Agreement, sets out exactly how the UK leaves, but not what happens afterwards. If it gets approved, a transition period has been agreed, allowing the UK and EU time to agree a trade deal and giving businesses time to adjust.

So what’s stalling the departure? Put simply, the UK government can’t agree on the deal. This could result in something you may have heard of: a hard Brexit. It’s a situation some fear will be damaging for the economy.

Let’s take a look at those two scenarios and how they will effect your Shopify store.

Brexit with a Withdrawal Agreement

If the Brexit withdrawal agreement is approved by the UK parliament, the UK will remain inside the EU VAT regime until the end of the December 2020 transition period.

This 21-month transition may be extended for a further 2 years if no free-trade agreement is concluded by the end of 2020 — this would extend the transition period until December 2022.

Until the end of this period, the UK will remain part of the EU VAT regime and there will be no major changes in the way VAT is charged.

UK and EU stores should continue to charge VAT to all EU and UK consumers, and business customers should remain tax-exempt.

This means that if the Brexit withdrawal agreement is approved, there is no need to update tax settings in your Shopify store for now.

No-deal (hard) Brexit

If no deal is reached, then a so-called “hard Brexit” will mean the UK’s relationship with the EU reverts back to World Trade Organisation (WTO) terms.

This means you should no longer charge VAT to some of your foreign customers and therefore you will need to make some changes in your Shopify store.

UK and EU merchants will need to update their tax settings in Shopify and may be required to include invoices with export documentation when shipping abroad.

UK stores selling to the EU

If your Shopify store is based in the UK, you should no longer charge VAT to EU customers.

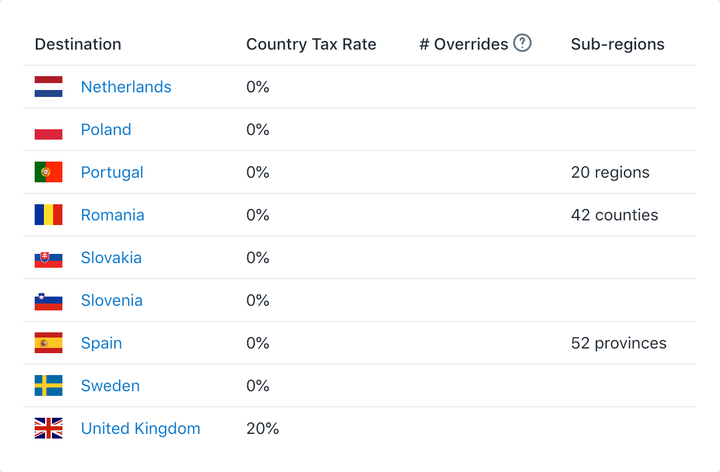

In your Shopify admin, go to tax settings and remove VAT from every EU country (besides the UK) from the list:

- Go to Settings → Taxes in your Shopify admin.

- Set the tax rate for each EU country to 0%. Keep the tax rate for the UK at 20%.

Bear in mind that your European customers will need to pay both customs duty (where applicable) and VAT at the time of import. This might have a negative cash flow impact on your business customers and might make your products less competitive on the European market.

You will need to get yourself familiar with the new rules for doing business overseas, and if you ship outside the UK, what export documentation you need.

EU stores selling to the UK

If your Shopify store is based in the European Union (EU27), you should no longer charge VAT to UK customers.

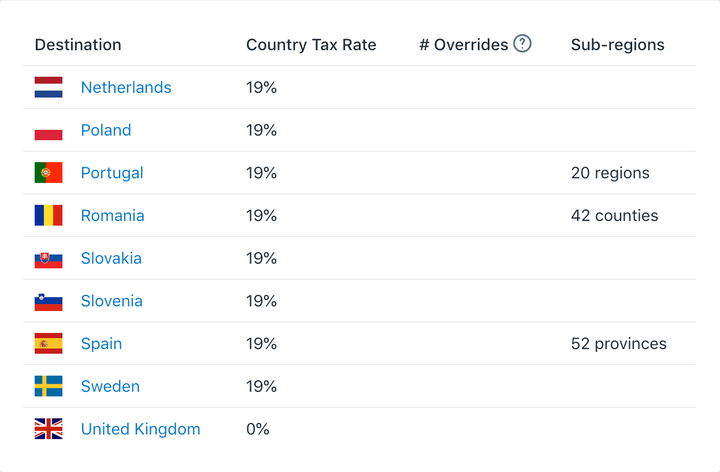

In your Shopify admin, go to tax settings and remove the UK VAT from the list:

- Go to Settings → Taxes in your Shopify admin.

- Set the tax rate for the UK to 0%.

There will no longer be any tax exemptions for UK business customers. If you are using Sufio to tax exempt business customers in your store, it will automatically stop tax-exempting UK customers.

Non-European stores selling to the EU and UK

For non-European stores selling physical goods to the EU or the UK, there will be no change in the way taxes are charged.

However, stores selling digital goods to the EU might be affected. If your business is registered with the VAT Mini-One-Stop-Shop (MOSS) scheme in the UK, you will no longer be able to use the UK’s MOSS portal to report and pay VAT on sales of digital services to consumers in the EU.

If you want to continue to use the MOSS system, you will need to register in a different EU27 country.

The MOSS scheme requires businesses to register by the 10th day of the month following a sale. For example, you will need to register by May 10, 2019 if you make a sale between April 13 and April 30, 2019.

Invoices

Regardless of the Brexit scenario, invoices remain vital documents when selling to business customers and when exporting goods abroad.

You will need to make sure that your invoices display the correct tax-breakdown and include all the required details about your business and your customers.

When selling abroad, commercial invoices can be part of your export documentation. You need to keep copies of your VAT invoices and proof of export. This helps you prove that the goods left the country and that you do not have to pay any output VAT on them.

Sufio can automatically create professionally-designed and compliant invoices directly from orders in your Shopify store. This could save you a lot of time and hassle, and ensures your business will abide by the new rules as soon as they come into effect.

Get your store ready

Whatever happens with Brexit, as a store owner it’s important to keep a close eye on the latest developments and make sure your Shopify store is prepared for either outcome.

The coming months will be the time to seek advice and plan for the potential scenarios to ensure your ecommerce business can emerge from the transition with the best possible chance of success.

We understand it’s all a bit complicated so if you have any questions, we’re more than happy to clarify them and assist you.

Professional invoices for Shopify stores

Let Sufio automatically create and send beautiful invoices for every order in your store.

Install Sufio - Automatic Invoices from the Shopify App Store