Brexit: 6 Questions Shopify Store Owners Are Asking

As 2020 draws to a close, Brexit still hangs in the balance. At times, it’s been hard to keep track of timelines, as deadlines have been extended, passed and been extended again.

Things are finally drawing to a conclusion, although it looks like final decisions will come down to the wire – and what that conclusion will be is currently still anyone’s guess.

The ecommerce industry needs to prepare for every eventuality. If the UK leaves the European Union without a trade deal, cross-border trade will inevitably be affected.

This article will aim to answer a few of the questions that you might have, with regard to the potential impact of Brexit on your Shopify store.

1. The Brexit Transition Period Is Ending: What Do I Need To Know?

The UK left the EU on January 31, 2020, and ever since has been operating within an agreed transition period. Until this period ends, travel, freedom of movement and, most importantly for Shopify store owners, trade has all effectively remained unchanged.

In June 2020, the UK formally rejected an extension of this transition period, meaning that is set to end at midnight, on December 31, 2020.

If a trade deal is not negotiated before this deadline, the UK’s relationship with the EU will default back to World Trade Organisation (WTO) terms.

What does a “no-deal” conclusion mean for European ecommerce, and Shopify store owners? There are some potentially far-reaching impacts to consider, from shipping complications, new tariffs, and the fluctuating value of the British pound.

The only thing we know for certain? At the stroke of midnight and the start of the new year – change is coming.

2. How Will A “No-Deal” Brexit Affect My Online Store?

Hypothetically, a “no-deal” Brexit could have a range of impacts on store owners operating across Europe.

A key consideration for online retailers will be the reinstated customs border between the EU and Great Britain (in terms of England, Wales, and Scotland). This will have an obvious impact on regulations, customs and duties, including new VAT rules for goods imported into the UK.

There’s also the potential impact on shipping times to factor in, as the industry adjusts to the new or additional checks, processes and protocols that will be necessary at the border.

In order to counter these potential delays and ensure the smoothest shipping possible, you’ll need to be sure that the documentation you include with your shipments is complete and compliant. Depending on where you are trading from and to, you may need to include:

- The amount of VAT collected on the shipment.

- Your VAT registration ID.

- Your EORI number.

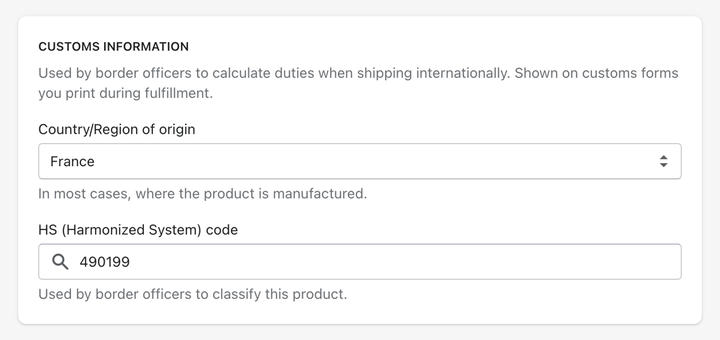

- Harmonized (HS) codes of your products, descriptions, countries of origin.

- The total value of each product included in the shipment.

All this amounts to an additional layer of bureaucracy and an increase in tax — no slight consideration, especially for smaller businesses.

All the more reason to lighten the load by streamlining your process with automated and compliant invoicing.

3. How Will Brexit Impact My Online Store’s Tax Settings?

With the customs border being reinstated at the end of the transition period, as UK and EU merchants you will need to check your Shopify store’s tax settings, and be ready to make some updates.

UK stores selling to the EU

At the end of the transition period, the UK will no longer be subject to the EU VAT directives that it currently operates within. Goods are no longer being sent from one EU member state to another EU member state, and this brings changes.

You might be required to register for EU VAT, and to account for import VAT in the EU. Depending on your supply chain, the location of your customers, and where your goods are delivered, VAT registrations might be required across multiple EU member states.

EU stores selling to the UK

When the transition period ends, all sales from the EU to UK consumers will be subject to import VAT.

For sales of goods in consignments not exceeding £135 shipped from the EU to a UK consumer, UK VAT should be charged at 20% in the checkout, by the seller. This means you can no longer collect the VAT from your customers via freight company. You’ll also need to be registered to pay UK VAT with HMRC.

If the value of the consignment is above £135, then the seller or the shopper can pay the UK import VAT (i.e. the current rules still apply.)

What does this mean for your Shopify store’s tax settings?

Well, it depends on how you currently manage them.

If you’ve already started using Shopify’s new registration-based tax settings, then your registrations will be automatically updated. Remember, this only applies to existing registrations – new registrations won't be automatically added though, and you won't be alerted if you need registrations in other countries.

It’s best to double-check with a tax professional if you have any concerns about what you might be liable for, as this depends on a range of factors which are different for every business.

If you’re using Shopify’s legacy tax settings, then your existing settings will need to be updated manually (and any new registrations added, depending on your businesses’ unique requirements).

Read more about update your Shopify tax setting manually.

4. Brexit: Do I Need To Change My Invoices?

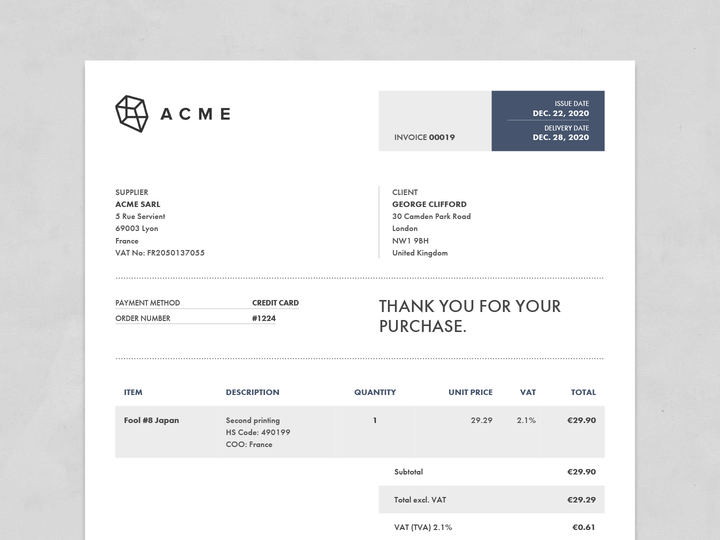

When selling abroad, commercial invoices can be part of your export documentation. As a result, invoices need to reflect the changes in tax and customs practices that Brexit will entail.

You need to keep copies of your VAT invoices and proof of export. This helps you prove that the goods left the country and that you do not have to pay any output VAT on them.

When goods are subject to customs charges, it’s also important to pay attention to HS (“Harmonized System”) codes. These are designed to help correctly classify your goods (i.e. how should a drone be classified – is it a toy, a camera, or something else entirely?) This helps to ensure that the correct taxes and any necessary tariffs can be applied.

HS codes are designed to ensure shipments are able to be quickly and accurately identified by customs officials. FedEx states “If you don’t include the HS code on the commercial invoice and other shipping documents, it could delay the shipment and you risk the receiver paying the incorrect duties and VAT.”

Sufio automatically creates well-designed and fully compliant invoices directly from orders generated your Shopify store. This could save you a lot of time and hassle, and ensures your business will abide by the new rules as soon as they come into effect.

5. Does Brexit Mean I Need A New EORI Number?

The short answer – maybe!

An Economic Operator Registration and Identification Number (EORI) is an identifying code that helps to track and register goods as they pass through the customs process.

A single EORI number can be used for all EU member states. When the transition period ends, of course this will no longer apply to the UK, and so two separate EORI numbers will be required, one for tax authorities in the EU and one in the UK.

The good news is, they’re freely available and simple to apply for.

EU EORI Number

Apply for an EU EORI number if…

- You import goods into the EU and you don't have an EORI number.

- You have an EORI number starting with GB that was issued by the UK.

To obtain an EORI number for an EU member state, contact their tax authority.

UK EORI Number

Apply for a UK EORI number if…

- You import goods into the UK and you don't have an EORI number.

- You have an EORI number issued by another EU member state.

You can register for a UK EORI number with HM Revenue and Customs.

6. How Should I Update My Terms & Conditions Following Brexit?

Import VAT and tariffs might be chargeable on your products after Brexit, and this will have an impact on the terms and conditions that you display in relation to your sales.

As customs charges and taxes will increase with the reintroduction of the border, you need to decide (and communicate) who is responsible for these extra costs – you or your customer? The choice is yours and either option has its benefits and drawbacks.

Make sure your Terms and Conditions clearly outline who is responsible for making the payments. Don’t leave your customer with an unwelcome surprise.

When communicating the way you choose to operate here, you can use the following international commercial terms:

Delivered Duty Paid (DDP) means that you (the seller) will be paying import costs. It means you’re liable for ensuring that the associated taxes are filled. Let your customer know that you’re going to this expense and trouble in your shipping policy.

Delivered At Place (DAP) shifts the obligation to your customer – you, as the seller, are only responsible for shipping the product. This will save you time and money, but you might see a bit less repeat custom from shoppers stung with charges they might not have expected. Again, be as clear as you can in your shipping policy, to avoid a shock for your customers.

Change is coming, time to get your Shopify store ready for Brexit…

With a trade deal hanging in the balance at the time of writing, we might not know exactly what the end of the transition period means for our Shopify stores – but we can still make sure we’re informed and ready for action.

Invoices will form a crucial component of getting ecommerce right in a post-Brexit landscape. Sufio can help you in two areas: reducing additional admin with seamless automation, and ensuring compliance, wherever and whoever you’re selling to.

See how Sufio can help your Shopify store with compliant, automated invoicing today.

Professional invoices for Shopify stores

Let Sufio automatically create and send beautiful invoices for every order in your store.

Install Sufio - Automatic Invoices from the Shopify App Store