If you own a Shopify store based in Canada, you need to understand when to charge Federal and Provincial taxes. This article will help you configure taxes for your Shopify store based in Canada.

The simplest rule for when to charge Canadian sales tax or not is whether your Shopify store is GST/HST registered.

Many businesses in Canada start as unregistered and are classified as a small supplier. Canadian businesses are required to register for a GST/HST number when they surpass a minimum threshold of CAD $30,000 over four consecutive calendar quarters.

If your quarterly revenue is equal to or under $30,000 over four consecutive calendar quarters, you are not required to register for GST/HST. You are classified as a small supplier and do not charge GST/HST to your customers.

When your revenue surpasses the $30,000 minimum threshold over four consecutive calendar quarters, you are required to register for GST/HST within 29 days. You also need to charge GST on the supply that made you exceed that threshold and henceforth.

In order for your invoices and receipts to be valid, they have to include your GST/HST number, also known as your business identification number.

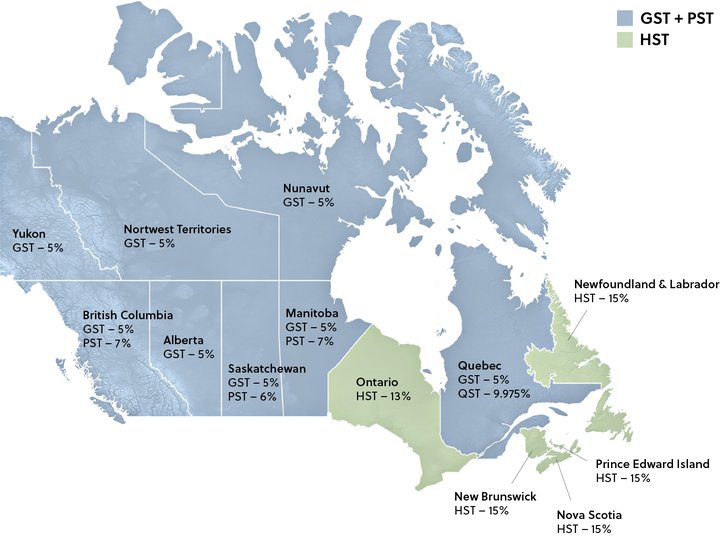

As a registered business in Canada, you will either charge GST, PST, HST or QST depending on where the order is placed from (the billing address of the customer).

The following table sets out which type of sales tax your Shopify store is required to charge, depending on where your customer is based:

| Province | Tax charged | |

|---|---|---|

| Alberta | GST 5% | |

| British Columbia | GST 5% + PST 7% | |

| Manitoba | GST 5% + PST 7% | |

| New Brunswick | HST 15% | |

| Newfoundland & Labrador | HST 15% | |

| Northwest Territories | GST 5% | |

| Nova Scotia | HST 15% | |

| Nunavit | GST 5% | |

| Ontario | HST 13% | |

| Prince Edward Island | HST 15% | |

| Quebec | GST 5% + QST 9.975% | |

| Saskatchewan | GST 5% + PST 6% | |

| Yukon | GST 5% |

Note

The tax charged depends on where the order is placed from (the billing address of the customer), not where your business is based.

In provinces where both GST and PST apply, two tax lines need to be shown on an invoice: one for GST and one for the PST amount. The provincial amount is remitted separately to the individual province, which can have its own registration guidelines.

If you are required to pay PST, you will need to register for PST separately in the relevant province, in addition to GST.

When you are selling goods or services within Canada, you must charge taxes to both consumers (individuals) and businesses.

Certain customers, such as governments, diplomats or indigenous people may be eligible for tax exemption. This means they may be able to claim rebate after the transaction has been made.

If you are selling goods internationally, you do not charge any GST/HST tax, provided that the delivery is outside of Canada. However, you still have to report the sales tax as 0% for taxation purposes.

Sufio will ensure that your invoices remain legal and compliant, and serve as a documentation that the order was shipped outside of Canada.

Certain goods (such as groceries, prescription drugs and feminine hygiene products) are classified as zero-rated, which means you don’t need to charge GST on them. However, you still have to display 0% tax on invoices for taxation purposes.

There are also goods that are tax-exempt (such as medical and educational services), which means neither GST, PST or HST applies to them. See this page for examples of zero-rated and tax-exempt goods in Canada.

Digital goods are intangible products that exist only in digital form, such as e-books, music, or online courses.

If you’re selling digital goods, the same tax rules apply. GST/HST is charged depending on the billing address of the customer. If the customer is located outside of Canada, no tax is charged. However, the invoice must display GST as 0% for taxation purposes.

Invoices for Shopify stores in Canada

Let Sufio automatically send invoices and receipts for every order made in your store.

Get Sufio - Invoices for Canadian stores from the Shopify App Store