A VAT (value-added tax) invoice is a document issued to give full details of a “taxable supply.” This means it’s an invoice that outlines the sale made when the goods in question are legally subject to sales tax.

A VAT invoice functions just as you would expect a standard invoice might, setting out the details relating to a specific sale. But additionally, a VAT invoice also provides all associated information on sales tax, as required by VAT law.

If you are a VAT-registered business, whenever you make a sale of goods or services (which are not VAT exempt) to another VAT-registered business, you’ll be required to issue a VAT invoice.

Because of the additional information they contain, VAT invoices record the rate at which VAT was charged and the total amount of VAT relating to the sale in question.

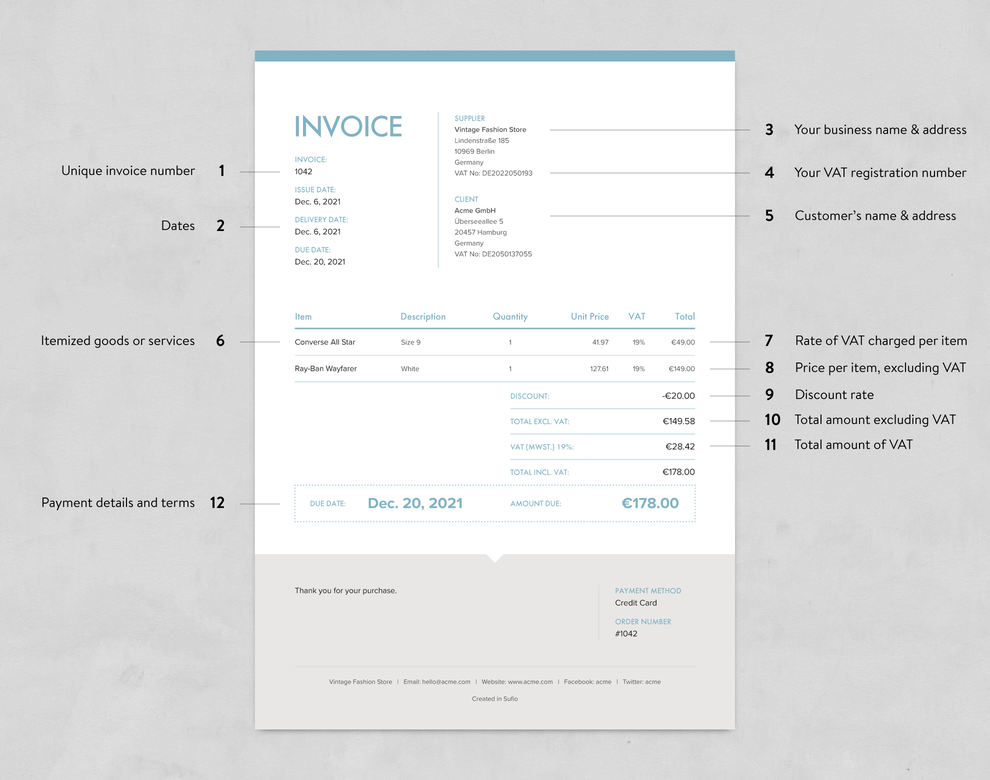

A VAT invoice contains everything a standard invoice needs, but it builds on it by adding VAT-related details relating specifically to the sale in question.

Let’s take a quick look at what should be included on a VAT invoice.

Unique invoice number

This is a unique number that helps to identify the invoice within your own accounting system. You can also use it to track payments made by requesting that this number be used to identify any associated transactions.

Some countries require that the numbers be assigned sequentially, so it might be worth reading up on your local requirements in advance.

Dates

Time stamping a transaction is a key function of an invoice, so including dates is essential. You should include the date of issue and the date of supply (sometimes referred to as “tax point”) if this differs from the date of issue. You might also wish to include the date at which payment is due.

Your business name & address

This section should include everything needed to identify and contact the one sending the invoice. Ensure your company name, address, and contact information are clearly stated.

Your VAT registration number

Any information needed to identify your businesses concerning tax must be included.

Customer’s name and address

An invoice should also clearly outline who is responsible for its payment. Include a client or customer name, address and any relevant contact information.

Itemized goods or services

Your invoice should clearly represent what the customer purchased and in what quantity. As a result, be sure to itemize your product list across separated lines, giving clear unit prices for each.

Rate of VAT charged per item

Different items may be subject to different tax rates, and your invoice must reflect this. Be sure to outline tax rates charged per item for total clarity. By itemizing your invoice, you’ll be able to clearly show where certain items may be exempt or subject to different rates. If no VAT is owed on an item, this should still be shown.

Price per item, excluding VAT

For each item on your invoice, give the net price before adding VAT.

Discount rate

If any discounts have been applied to items included within the invoice, they should be clearly shown.

Total amount excluding VAT

Show the full amount owed for all items on the VAT invoice, exclusive of VAT.

The total amount of VAT

Your invoice should also give the total amount of VAT owed (for all items, as one figure.)

We’ve looked at the information that helps keep your VAT invoices fully compliant. Now it’s time to think about how your VAT invoice is designed.

The best invoices go beyond offering a simple path to payment. They’re a chance to improve the customer’s experience and build on the relationship people have with your brand.

Trust is an important factor in business, and it becomes especially relevant when payments are involved. Anything that can help to add to the impression of professionalism that your business creates should be welcomed—and a beautifully designed and presented invoice would be a decisive winner here.

Do you have questions about invoicing for your online store? Let's have a chat!

Our team is here to provide answers to your questions and also guide you through setting up Sufio to manage your invoicing effectively.

Book a free callEvery VAT invoice sent gives you a chance to create a powerful branding touchpoint. By paying attention to the design of your invoice, you can help to improve the feeling of consistency that your customers experience.

Want to see how your VAT invoices could look? Discover our professionally designed templates and take a chance to strengthen your brand.

Professional invoices for online stores

Let Sufio automatically create and send beautiful invoices for every order in your store.