Why Is E-Invoicing the Talk of the Town Right Now

For Shopify store owners, e-invoicing is becoming a critical requirement as global mandates take effect. Countries across Europe, Asia, and beyond are increasingly enforcing e-invoice regulations.

While many businesses already generate PDF invoices automatically and send them via email, this practice alone may not comply with emerging standards.

What are e-invoices?

Generally, e-invoices are invoices prepared for automatic processing by accounting systems.

Unlike the usual paper or PDF document with information laid out for easy reading, an e-invoice is a file—typically in XML format—that contains structured text-only data. This is difficult for people to read, but straightforward for computers to process.

In some countries, the PDFs and XMLs are kept separate, while in others, like Germany and France, the structured data can be embedded in the human-readable PDF invoices.

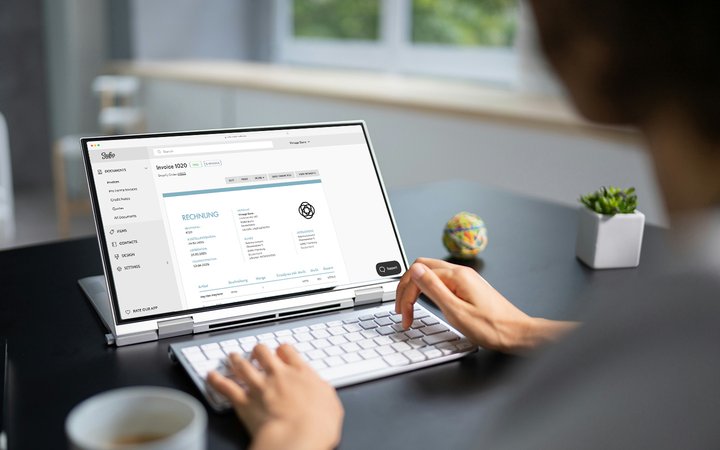

E-invoices created by Sufio for Germany and France combine the best of both: they are professionally designed PDFs that also include the data in XML format as attachments.

Please note that each country (or region) may use its own technical solution, from the specific file type, through the required data and its structure, to the specific transmission of the e-invoice file to the customer or a government system. The technical requirements were not harmonized globally and therefore vary from country to country.

E-invoicing reduces errors and tax fraud

What are the benefits of e-invoices? The countries mandating their use typically highlight the following:

- Environmental friendliness. E-invoices further push businesses to go fully paperless with their documents, saving resources.

- Efficiency. Compared to a person typing the information into an accounting system, automatic invoice processing speeds up operations and reduces human error.

- Compliance. The requirement to issue e-invoices helps prevent tax fraud.

- Traceability. Countries can directly compare the e-invoices issued and received, which further reduces the risk of mismatches in invoices that could potentially be fraudulent. This also means auditing is easier in general.

Many countries, from El Salvador to Italy, have reported an increase in tax revenue and reduced tax fraud thanks to the adoption of e-invoicing.

Leaders in e-invoicing adoption

E-invoicing was first launched in 2003 in Chile, shortly followed by Brazil and Mexico. Adoption in Latin America was supported by the Inter-American Development Bank (IDB).

As of 2025, nearly 90 countries worldwide are currently implementing e-invoicing, according to the IDB.

In the EU, adoption of e-invoices is part of the VAT in the Digital Age (ViDA) initiative, adopted this year. The package also includes improvements to the Import One-Stop Shop (IOSS) framework and real-time digital reporting for cross-border trade.

Typically, the rollout process is divided into stages, starting from mandating e-invoicing in business-to-government (B2G) transactions and progressing to business-to-business (B2B).

Usually, larger companies (measured by their annual turnover) are required to start issuing e-invoices first, followed by smaller companies up to microbusinesses and individual entrepreneurs.

Increased burden for businesses

The gradual rollout acknowledges the increased burden on businesses. Companies must transition to accounting or enterprise resource planning (ERP) systems that support issuing and processing of e-invoices. Where governments also mandate specialized electronic transmission methods (beyond standard email), businesses must implement additional systems as well.

Next steps for your business

To successfully transition to e-invoicing, businesses need to take proactive steps to ensure compliance and streamline operations. Here are key actions to get started:

- Review local legislation. Determine if your country is starting to mandate e-invoices—or offers them as a voluntary option for now.

- Understand the timeline. Confirm when you are required to start issuing or processing e-invoices.

- Identify required standards. Ensure you use the appropriate standard for e-invoices. Typically, online validators are available to check compliance of an e-invoice with local legislation.

- Verify software readiness. Ensure that the software you are using is ready for issuing or processing e-invoices.

- Communicate clearly with business partners. Inform suppliers and customers about your adoption of issuing and processing e-invoices and clarify what it means for them.

E-invoices by Sufio

At Sufio, we are committed to keeping you compliant with the latest e-invoicing regulations worldwide. Our app is continuously updated to ensure that every invoice we generate meets the legal requirements, giving you peace of mind.

For Shopify stores based in Germany and France, Sufio already includes the necessary XML file for e-invoice processing as an attachment to your PDF invoices. We support the correct formats: ZUGFeRD for German Shopify invoices and Factur-X for French Shopify invoices. This also applies to Shopify credit notes, which are automatically generated for returns and refunds in your online store.

To further ensure compliance, Sufio guarantees that these documents cannot be altered after they are issued to your customers. Plus, we offer secure storage for your invoices for up to 10 years.

We are actively expanding our e-invoicing support to more countries, ensuring you meet all deadlines effortlessly. Join Sufio today and experience seamless, compliant e-invoicing for Shopify that grows with your business.

Professional invoices for Shopify stores

Let Sufio automatically create and send beautiful invoices for every order in your store.

Install Sufio - Automatic Invoices from the Shopify App Store