As a Shopify store owner, it is crucial to understand how VAT operates in Switzerland. This includes VAT on goods sold to businesses and consumers in and out of the country.

Navigating VAT rules can be a real headache, though.

That’s why we wrote an article that will help you understand this topic and make sure your Shopify store is set up correctly to charge VAT in Switzerland.

In this article, we will discuss:

- Switzerland’s relationship with the EU

- The scope of Swiss VAT

- How to charge VAT when your business is not VAT-registered

- How to charge VAT when your business is VAT-registered

Switzerland is a member of the European Free Trade Association (EFTA) and a member of the Schengen area, but not the EU or EU Economic Area.

As a non-EU state, it is not bound by EU regulations on VAT. However, its geographical location and close ties with the EU—such as its membership in the EFTA and Schengen area—require Switzerland to align with some EU policies and practices. Read on to find out more.

Swiss VAT applies to an area commonly known as the “Swiss territory”, “Inland” or “territoire Suisse”. This region includes Switzerland, Lichenstein and Büsingen am Hochrhein (a German municipality).

The most significant distinction for your business is whether it is VAT-registered or not.

Many businesses start as VAT unregistered, but once your turnover reaches a certain threshold for the year, you must register for VAT. The VAT registration threshold for this tax year for goods sold in Switzerland is CHF 100,000. You can also voluntarily register for VAT in Switzerland at any time.

If your taxable turnover is below the VAT threshold and you are not VAT-registered, you do not have to charge VAT.

If your business is in Switzerland and you are VAT-registered, you must charge VAT to some customers and not others. It all depends on where your customers are located.

If you are selling goods to customers—either businesses (B2B) or consumers (B2C)—in Switzerland, then you have to charge VAT.

If you are selling to customers, either B2B or B2C, outside of Switzerland, then you do not charge VAT. These sales are exempt from Swiss VAT. However, you must provide evidence of the export, such as the electronic export declaration or the customs receipt, to claim the VAT exemption.

Once the goods enter the country of destination, they may be subject to the destination country’s VAT and customs duties, depending on the specific regulations and thresholds. For example, in accordance with EU VAT rules, B2B sales from Switzerland to the EU are subject to the reverse-charge mechanism, meaning that the recipient of the goods accounts for the VAT on their own VAT return rather than you charging VAT at the point of sale.

These rules also apply to the sale of digital services.

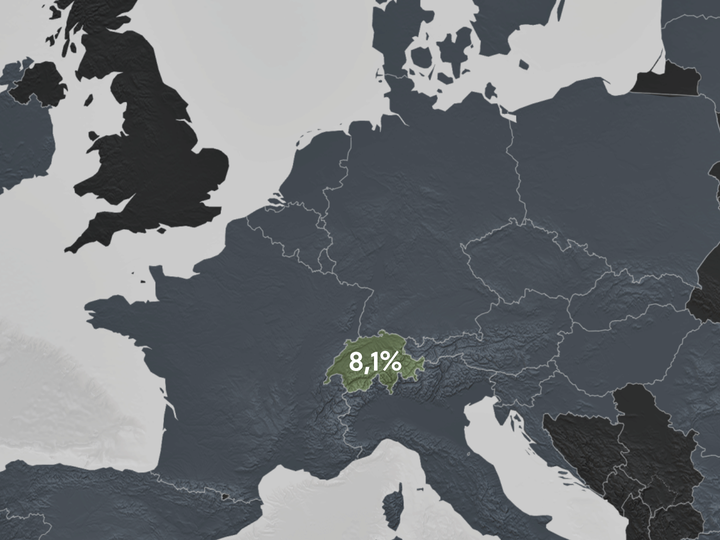

As Switzerland is not in the EU, it is not governed by the EU minimum VAT rate of 15%. Switzerland can set its own VAT rates, which is why they are much lower than countries based in the EU.

Most goods are standard rate which is charged at 8.1% (set to rise to 8.8% in 2026). You should charge this rate unless the country classed the goods as special or reduced. Exports from Switzerland are exempt from VAT.

The special rate is charged at 3.7% and includes accommodation serviced. The reduced rate is charged at 2.5% and includes medicines, food and newspaper books.

There are three different VAT rates in Switzerland: standard, special, and reduced rates.

Regardless of whether your goods are standard, reduced, or zero-rated, you must always show the VAT information on your invoice.

Sufio will automatically create valid invoices with a detailed breakdown of the VAT charged.

After you configure tax rates in your online store with a breakdown of the VAT charged, Sufio will automatically create valid invoices. This ensures that you are complying with the specific invoicing requirements in Switzerland.

The app can also generate invoices in multiple languages and include all the details needed to comply with invoicing legislation globally.

Having the correct tax breakdown on invoices is essential to your bookkeeping and your tax purposes.

Professional invoices for Shopify stores

Let Sufio automatically create and send beautiful invoices for every order in your store.

Install Sufio - Automatic Invoices from the Shopify App Store