Why Invoices Are Crucial for Online Stores that Want to Sell Worldwide

Have you ever had a request for an invoice from a customer? For online merchants who sell internationally, this could be pretty common.

Typically, retailers will include a receipt with a customer’s purchase. The receipt outlines what was purchased, who was involved in the transaction, when it occurred and which payment method was used.

An international customer requesting an invoice isn’t looking for a receipt. Instead, they’re looking for a fully-compliant invoice that includes a bit more detail.

Instead of letting your customer support team handle these requests on a case-by-case basis, you could make invoices a standard inclusion with all orders. Let’s take a look at why this is a good idea and what you’ll need to keep in mind.

The Benefits of Invoicing

Let’s kick things off by diving into the specific business benefits of invoicing your customers.

Increase efficiency

Every business owner would like their business to be more efficient. By making internationally compliant invoices a standard part of the purchase process, you’ll have less follow-up and back and forth with customers when they request invoices.

Additionally, thanks to our invoice templates, all your invoices will have the same information in the same places. This improves your business’s record-keeping — rather than having a mix of invoices and data, making it easier to stay organized, and generate invoices that meet a high standard.

Abide by legal requirements

We’ll touch on this more later as well, but abiding by international legal requirements is absolutely critical to online retailers who want to sell to a global customer base. This requires legal compliance, both in the location where you operate and in the locations where your customers are based.

This becomes even more important for B2B retailers that sell to companies rather than individual consumers. Business taxes and accounting practices are far more complex than personal finances — and they’re also likely spending more money — so invoices are critical.

Improve the customer experience

The most important component of your business is your customers. They decide if you succeed or fail, so it’s up to every company to do their best to provide a positive customer experience at every stage of the purchase process.

Eliminating post-purchase back-and-forth between the customer and your support team regarding invoicing is one way to anticipate customers’ needs and avoid a potentially negative interaction.

Also, bear in mind that if you don’t invoice properly for international shipments, the destination country could estimate the value of the package incorrectly, thus potentially costing the customer more in import fees. No customer wants to pay unexpected costs.

Strengthen your brand

Remember: Post-purchase communications are just as important as your interactions leading up to the sale — it’s critical to keep the brand experience consistent across all touchpoints. Post-purchase is where customer retention and word-of-mouth marketing come into play.

Invoices provide an additional branding opportunity where you can set yourself apart from competitors. Maintain a consistent look-and-feel and brand voice — and consider including a call-to-action to join your customer loyalty program or use a promo code on their next purchase.

The Legal Stuff

Legal compliance is so important that it’s worth going into a bit more detail.

In the US, for example, invoicing and accounting legislation is less strict than in the EU or Australia. However, as technology and the world of ecommerce increasingly connects brands with a global consumer base, it’s also becoming more important to be aware of, and comply with, international regulations. In some countries, customers need proper invoices for their own accounting and tax reporting purposes.

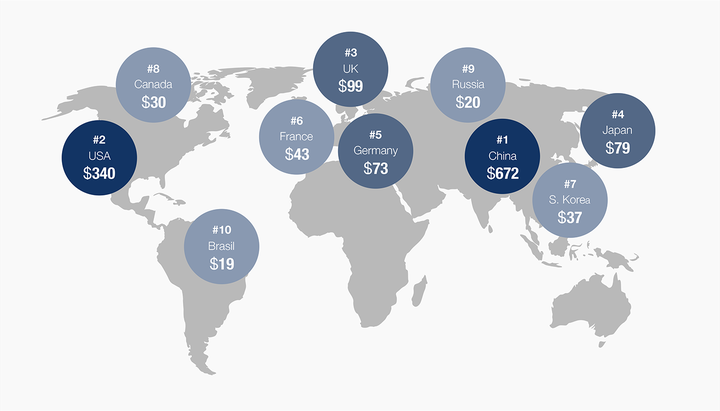

Selling internationally is a strategic move for businesses that want to drive growth. According to Business.com, the US doesn’t even have the largest consumer base — China does. Also, nearly 16% of China’s total retail sales come from e-commerce, compared to the UK at 14.5% and the US at 7.5%.

Here are some examples of things you’ll have to consider when invoicing to different countries:

- Amongst other regulations, invoices in the UK must have the word “Invoice” included on the document.

- In the EU, invoices must display the “nature and type of services” provided.

- In China, the fapaio invoice requires companies to pay tax in advance on their future sales. This type of invoice therefore serves as a warranty against tax evasion, unlike other countries where invoices serve as a tax receipt.

- Australia charges tax on goods which are considered “connected with Australia”.

- In Singapore, invoices should be titled “Tax Invoice” if the customer is GST-registered.

If you don’t abide by legal requirements, you could face fines, payment delays, tax penalties or even difficulties continuing to do business in that country.

Sufio invoices are compliant with legislation in over 50 countries, meaning compliance is one less thing you have to worry about.

What to Put on Your Invoices

Every country has its own requirements for invoices, so it’s best to familiarize yourself with those guidelines. Pay extra attention to the countries where you have the largest customer base.

While your ecommerce platform may already automatically create and send a default email receipt, this isn’t comprehensive enough to meet all international standards. These emails lack the information to be considered a valid tax invoice.

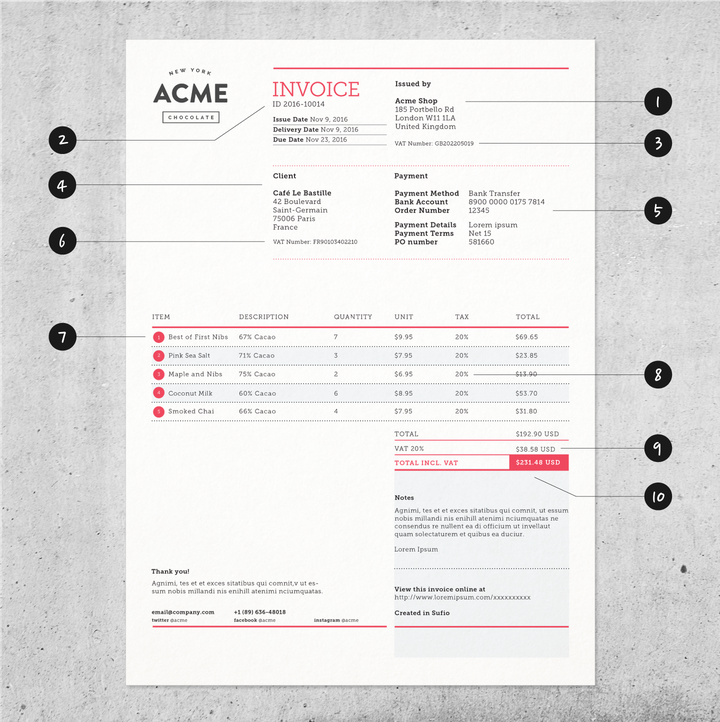

Invoicing requirements may differ from country to country, so it's always best to use an invoicing app that supports different accounting legislations. Here’s a checklist of common requirements:

- Your business name and address

- Unique invoice number

- Your tax ID (VAT or GST number)

- Customer name and billing address

- Payment details and terms

- Client’s tax ID (VAT or GST number)

- List of items sold, including quantity, unit price and total

- Tax rates per individual items

- A full breakdown of tax rates and tax amounts charged

- Total amounts exclusive and inclusive of tax

Conclusion

Ready to create impactful and compliant invoices for your growing online store? Sufio is an automatic invoicing app that Shopify merchants can use to create and send beautiful invoices — no coding skills required.

With Sufio you can create invoices that have all of the international requirements and branding that matches your store. You can automatically send invoices for every order, and allow your customers to download their invoices whenever they want.

Try Sufio and start creating professional invoices for your Shopify store.

Professional invoices for Shopify stores

Let Sufio automatically create and send beautiful invoices for every order in your store.

Install Sufio - Automatic Invoices from the Shopify App Store