Invoices Explained: What Are the Different Types?

While running your own business can be a hugely fun and rewarding experience, it also requires keeping on top of some essential administrative tasks―such as invoices.

But there’s more than one type of invoice, and understanding which one to use can be vital so you are paid correctly and able to keep your cash flow consistent.

Nowadays, apps like Sufio make automatically creating and sending professional invoices super simple; however, it’s still incredibly useful to know the different types.

This article will cover some of the most common invoices used in business. Our list isn’t exhaustive, but it should help you to understand some of the key ones you will come across.

First, let’s start by getting to grips with what an invoice is and the purpose they serve…

What is an invoice?

An invoice is a commercial document that outlines the buyer's obligation to pay a seller for specific goods or services.

Invoices include essential information, such as itemized pricing and when the payment is due, to allow businesses or individuals to understand the exact nature of the transaction that is taking place.

The purpose of invoices can vary depending on your country; the documents can serve as an obligation for the buyer to pay the seller or, in cases where it's issued right after checkout, to confirm that the business fulfilled the order.

Various types of invoices exist to meet a range of use cases, but essentially they all fulfill the same function; ensuring correct and timely payment for goods or services rendered.

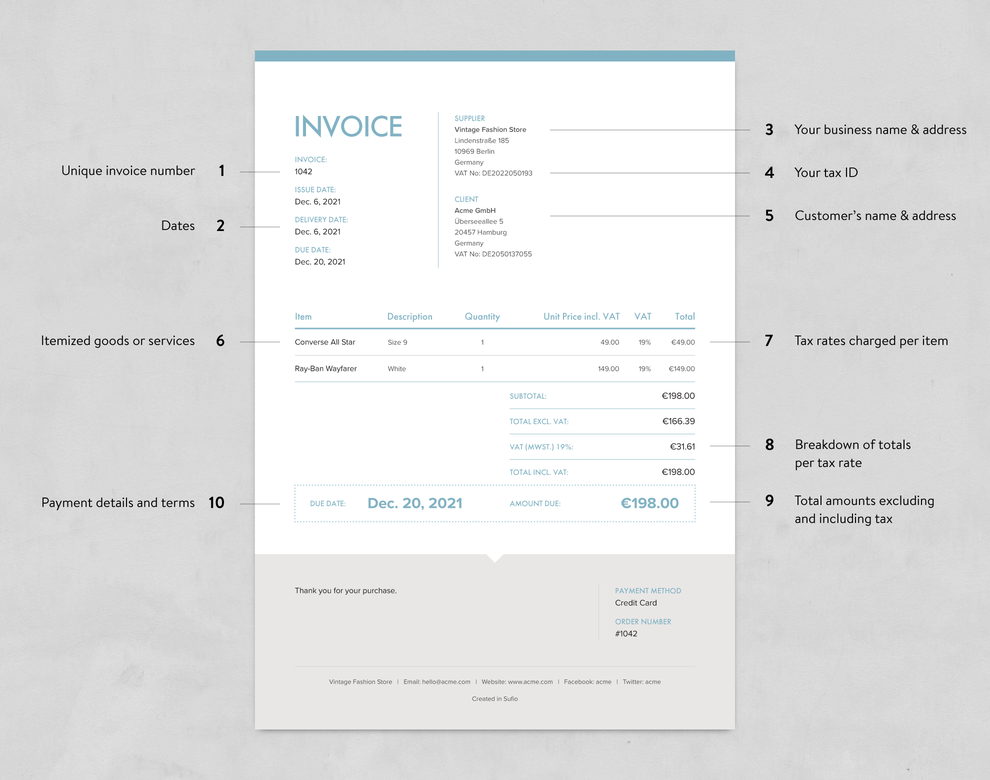

Standard invoice

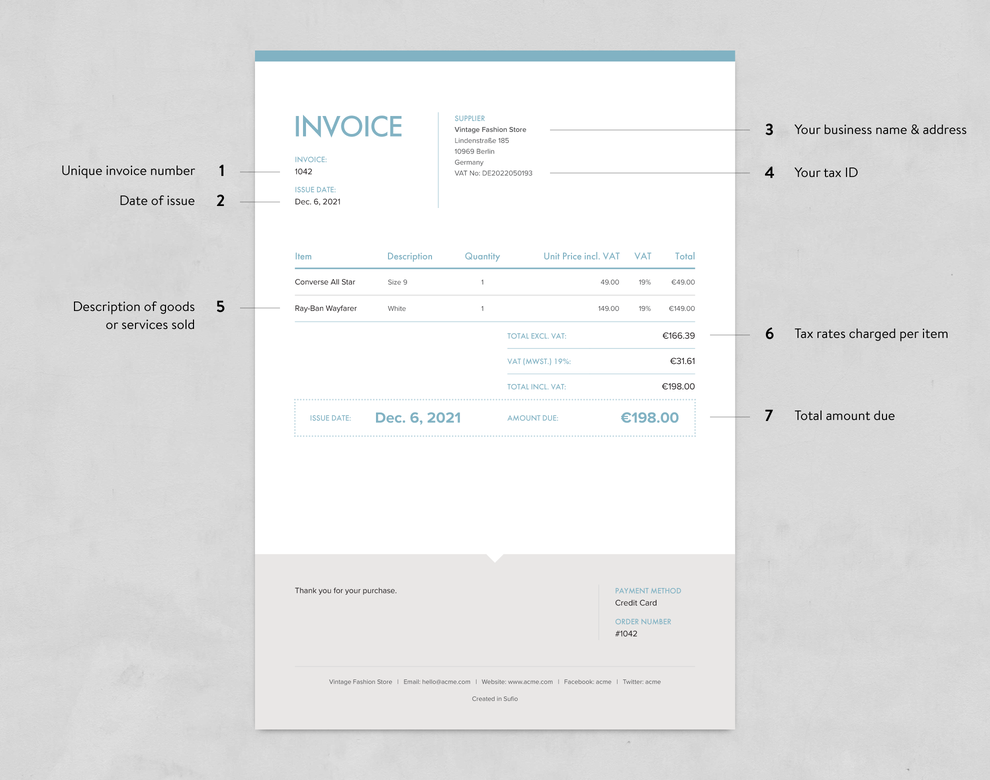

A standard invoice is the most common form of invoice and is used by the seller to request payment for a product or service from the buyer.

Standard invoices usually include fields containing the seller’s information, the buyer’s contact details, the items or services purchased, the total price, and payment terms.

It also has information the buyer can use to make payments, such as bank details and payment links.

The invoice acts as a legally binding contract, and once the payment has been made, it also becomes a legal record of the transaction.

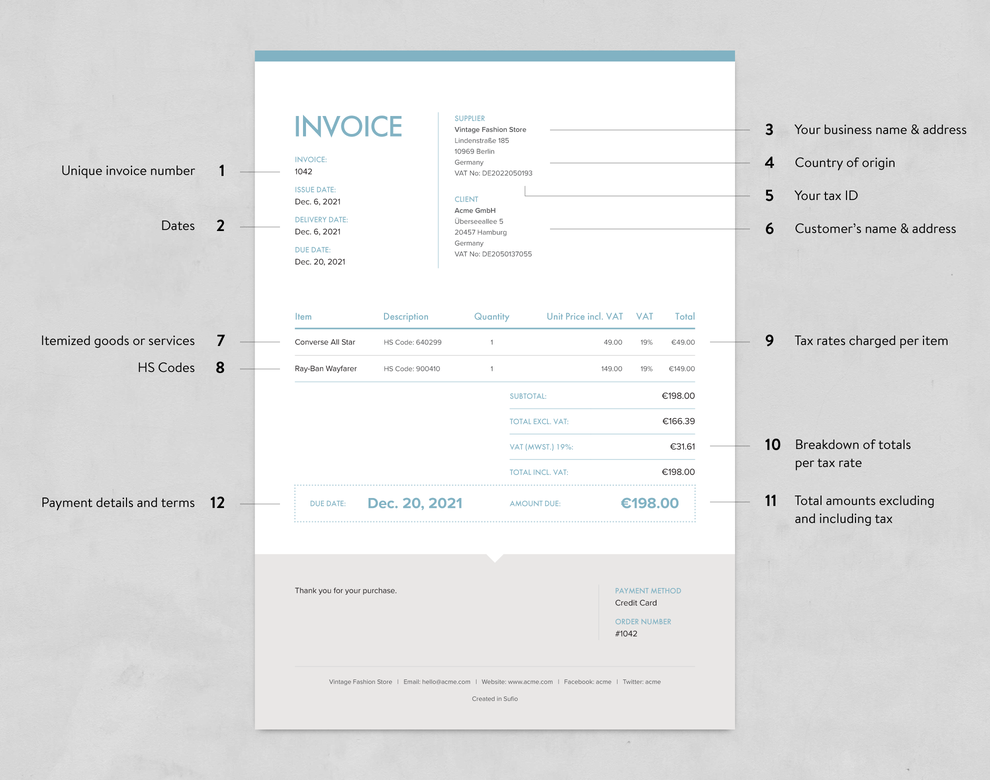

Commercial invoice

A commercial invoice is a customs document that enables goods to be shipped by a person or business across international borders.

Commercial invoices inform customs authorities about exactly what a delivery contains and the taxes or duties that might be incurred.

When correctly completed, a commercial invoice can help avoid delivery delays, extra charges, and a poor customs experience for both parties, allowing shipments to move seamlessly through the international delivery network.

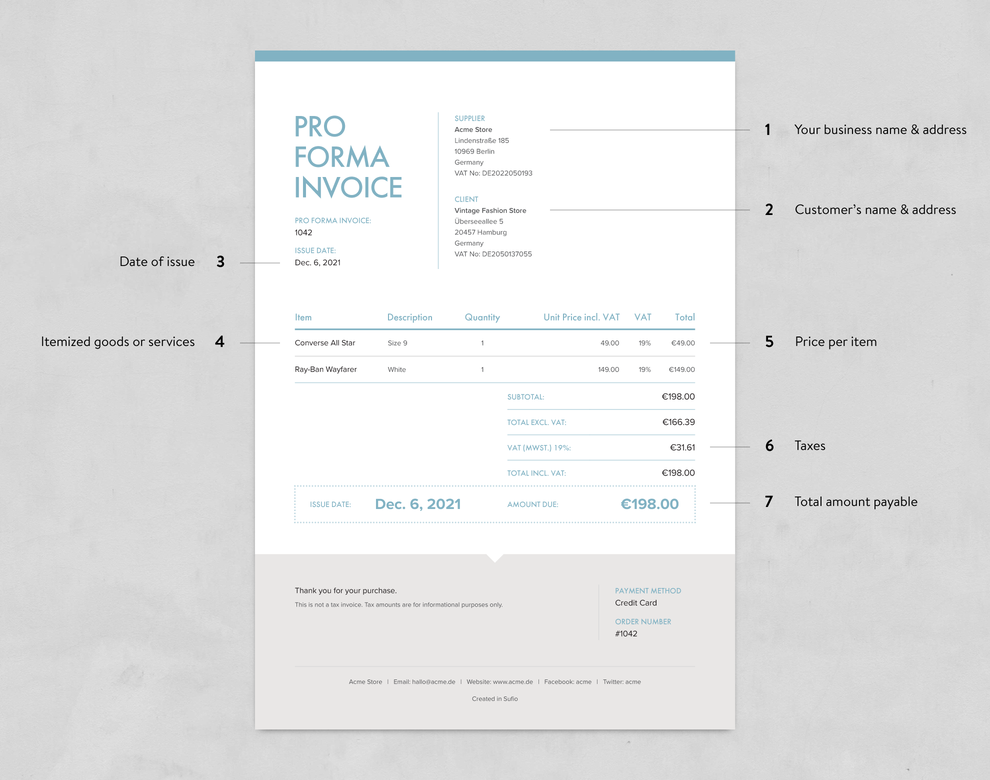

Pro forma invoice

A pro forma invoice is an estimated invoice that the seller sends to the buyer before providing any goods or services.

It includes the estimated cost of the work, delivery date, and any other relevant details.

The buyer can then review the pro forma invoice and give the go-ahead to the seller to start working on their side of the deliverables or request changes and in which case a new pro forma invoice will be issued.

Some of the fields mentioned in a pro forma invoice include the items or services to be sold, their quantity and price, delivery date, and the shipping address.

Pro forma invoices may have to be altered once a project has been completed to accurately reflect the work.

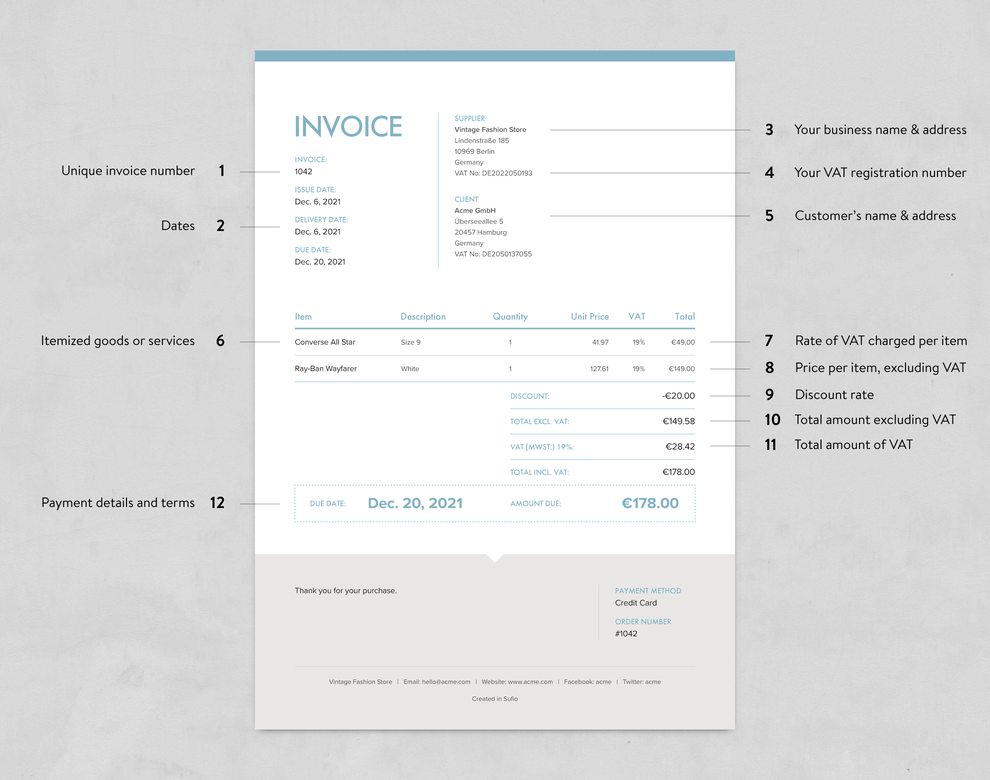

VAT invoice

A VAT (value-added tax) invoice is a document issued to give full details of a “taxable supply.” This means it’s an invoice that outlines the sale made when the goods in question are legally subject to sales tax.

It serves the same function as a standard invoice, but in addition, it also provides all associated information on sales tax, as required by VAT law.

When a VAT-registered business makes a sale of goods or services which are not VAT exempt to another VAT-registered business, then a VAT invoice must be issued.

VAT invoices record the rate at which VAT was calculated and the total amount of VAT relating to the sale in question.

Simplified invoice

A simplified invoice is a type of VAT invoice that can be used to detail a domestic retail transaction that totals less than a certain set amount. This threshold varies by country. For example, in the UK, it’s £250 while in Italy, it’s €400.

They tend to be sent for lower-value orders and contain less of the information you’d usually expect to include on a standard VAT invoice.

Simplified invoices still function the same way as a VAT invoice and set out the details relating to a specific, taxable transaction with all the necessary information required by VAT law.

The key difference between the two is the amount of detail about the documented transaction.

Certain details can be omitted from a simplified invoice―as the name suggests―to keep lower-value orders streamlined. Typically, you don’t need to add the customer’s name or address, the date the invoice was issued, or detailed information about prices or VAT. You just need to include the total amount owed, inclusive of VAT.

Conclusion

Various types of invoices exist to meet a range of use cases, but essentially they all serve the same purpose―to ensure correct and timely payment for goods or services provided.

They can be straightforward and functional documents, or they can be an opportunity to give a good impression and deliver a truly impactful brand experience for your customers.

By taking care and consideration over the design of your invoice, you can help to build your customer’s trust―something that all businesses should focus on when it comes to payments.

Want to showcase your brand’s style and personality with fully compliant invoices? Try Sufio and create an invoice your customers will want to keep.

Professional invoices for Shopify stores

Let Sufio automatically create and send beautiful invoices for every order in your store.

Install Sufio - Automatic Invoices from the Shopify App Store