This guide will help you set up taxes for your Shopify store based in Australia.

Note that you are required to charge GST only if your annual turnover is over AUD $75,000.

All orders within Australia are GST-taxable aside from a few exceptions mentioned in our Australian tax guide article. Sales outside of Australia are also taxable unless the goods or services are exported within 60 days from payment.

You can set taxes for your store in Settings → Taxes of your Shopify admin.

If you are missing Australia in the Tax rates list of countries, you will need to add it as a shipping zone first.

- If you do not see Australia in the Tax rates list, go to Settings → Shipping→ Shipping profiles and click Create new profile.

- Click Create Shipping zone and select Australia.

Once you have Australia included in your Tax rates list, you can set up its taxes.

To set up tax rates for Australia:

- Go to Settings → Taxes in your Shopify admin and click Australia.

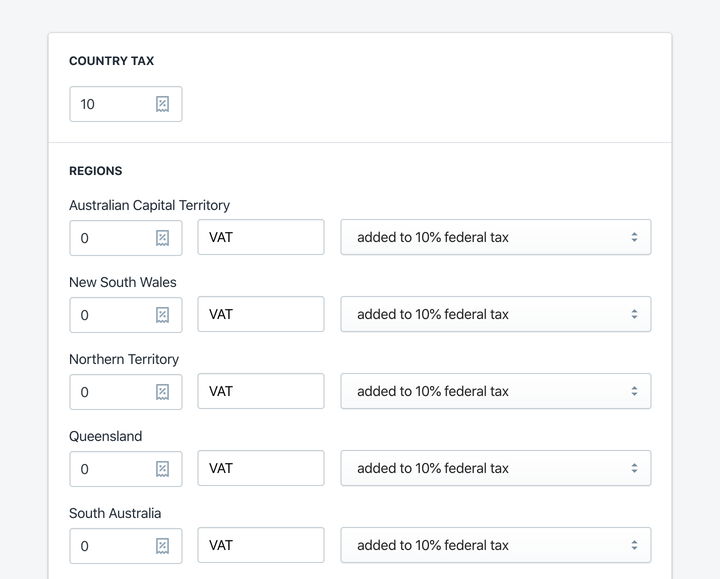

- Set-up the 10% GST tax by entering 10 into the Country Tax field.

- Leave the states and territories with 0% tax and choose added to 10% federal tax from the drop-down.

If you are selling input-taxed or GST-free sales where no GST is charged, you will need to set-up tax overrides.

To set-up tax overrides in Shopify:

- Go to Settings → Taxes in your Shopify admin and click Australia.

- Scroll down to Tax overrides.

- Add a collection of products from your store that are subject to input-tax or GST-free sales and set their Tax Rate to 0%.

Get your free Shopify Tax Guide

Charging your customers the correct tax rates is essential for your business.

Get a free copy of our easy-to-read guide and kick off your sales!

Sufio invoices are compliant with accounting legislation in Australia. They also serve as valid documentation for both GST taxed and GST-free orders shipped both within Australia and overseas.

Issuing invoices with a correct tax breakdown is vitally important for your bookkeeping and tax purposes.

If you are selling to businesses (B2B), Sufio invoices display all the required information including your ABN (Australian Business Number) and your customers' ABN.

Invoices for Shopify stores in Australia

Let Sufio automatically send invoices and receipts for every order made in your store.

Get Sufio - Invoices for Australian stores from the Shopify App Store