VAT Compliance: What You Need to Know When Growing Internationally

Start quickly and test new markets with cross-border deliveries―Filing via One Stop Shop

It has never been easier to grow an online business internationally into new markets―especially in the EU. With Shopify, it only takes a few clicks within the admin interface, and new countries are instantly added to your store's sales territory. With options like this, the question of storage and shipping abroad quickly arises.

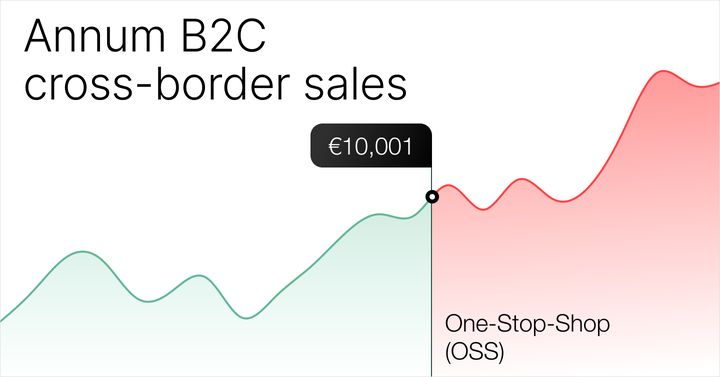

To be able to start quickly and gain experience while saving costs, most online retailers start out with cross-border shipping from their own warehouse in their home country. From a legal tax point of view, this is possible up to an annual cross-border turnover of €10,000 with the local VAT applied and without further declarations.

However, if the international annual sales, which are sent from the home country abroad, exceed the mark of €10,000, the One-Stop-Shop (OSS) regulations take effect in the EU. From this point on, the VAT rates of the recipient country must be applied to the sales, and an OSS report must be submitted to the domestic tax authorities every quarter.

While hiring a professional advisor is a good idea to ensure that your tax affairs are in order, many individual administrative aspects of tax compliance can now be delegated to modern software solutions.

Automation allows thousands of data points to be entered in a matter of seconds without the computing errors that human workers are bound to make. This can save employees the many hours required to perform such work manually, freeing up time to focus on higher-level tasks.

Founders who lack experience in accounting may not realize just how much of their accounting—from payroll to invoicing—can be handled by automation software.

Enable an outstanding customer experience with decentralized fulfillment―Filing via local authorities

In recent years, new standards have been set in online retailing with Amazon Prime and guaranteed next-day delivery, so customers now mostly expect orders to arrive at their homes within 24 hours.

However, from a tax perspective, this decentralization means that registration and ongoing sales tax reporting―monthly or quarterly―become mandatory in each country where goods are stored. In the past, the high effort and costs involved have often meant that smaller retailers have not pursued further international growth despite good demand for their own products.

Focus on further growth while setting your international VAT obligations on autopilot

In order to lower these barriers and make it easy for their customers to grow internationally, Sufio has recently partnered with countX, a full-service provider for VAT compliance. The German-based company's offerings range from domestic OSS filings to local registrations and ongoing VAT reports in all foreign European countries. Fully automated, at an affordable monthly cost rate, and always with a personal VAT expert at your side.

Additionally, a direct data integration allows customers to upload invoice data exports from Sufio directly into the countX system, which will automatically be processed for all needed VAT reports. countX offers a free consultation to discuss current and future VAT obligations, which can be booked directly here.

Professional invoices for Shopify stores

Let Sufio automatically create and send beautiful invoices for every order in your store.

Install Sufio - Automatic Invoices from the Shopify App Store