3 Tips for Selling Online in Multiple Currencies

Shopping online is getting all the more popular still. If you'd like to take advantage of this trend, you should be prepared to accommodate your customer's needs.

Having to convert prices during shopping distracts the shoppers from a purchase and additional browsing might lead to cart abandonment.

As a bonus, giving your customers an option to shop in their local currency enhances your customer experience.

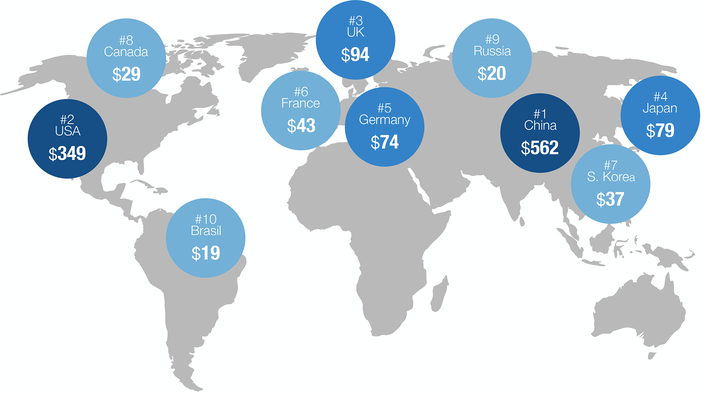

E-commerce around the world

If you're planning on expanding your business into new markets, supporting multiple currencies may significantly help you boost your revenues.

In Asia, online retail is predicted to develop rapidly in the next five years. Ecommerce in China is growing at record rates of about 40% per year and India is said to be experiencing an ecommerce revolution. Even on developed markets, there’s still plenty of room for growth.

With shipping costs still decreasing, it is even easier to expand on global markets and reach new customers.

Whether you're just considering selling in multiple currencies or you are already on board, there surely are many questions that come to your mind. Here are 3 tips you should know before selling in multiple currencies:

1. Support currencies of your customers

Supporting the world's most eminent currencies is always a good idea. Most products worldwide are sold either in the US Dollar or Euro, British Pound is also quite popular in some parts of the world.

Regardless of this, you should make a thorough research on what countries most of your end consumers come from and adjust to that. Keep in mind, though, that there is no need for you to support every available currency. It is your online store, not a currency exchange, so examine your customer base and decide on the most feasible ones.

As a rule of thumb, think about supporting a local currency if at least 5% of your customers come from that country.

2. Choose the right way to price your products

When it comes to pricing, you can either convert your prices manually or set up an app that will do this for you automatically.

Manual pricing

- You have control over your prices. Suitable for stores with a small number of products.

- Takes time to update prices to reflect the latest currency exchange rates.

If you have a stable, unchanging and relatively small product selection in your online store, manual conversion is a more convenient option for you. Your customers might get used to your prices and if they see them constantly increasing (or decreasing) due to changing currency rates or inflation, they might find it odd.

Automatic pricing

- Great for stores with many products. Prices are automatically converted multiple times a day using the latest exchange rates.

- No psychological pricing (no round prices).

Currency conversion apps are user-friendly and provide great and always accurate conversions. Plus, you save plenty of time! Bear in mind that currency rates change as often as weather and your prices will too. For this reason, automatic pricing suits best to stores that often update their inventory.

If you have your online store on Shopify, we recommend using the Coin app. It supports over 160 currencies, updates your prices every hour and even allows you to round the prices to whole numbers.

3. Send invoices and accept payments in multiple currencies

It is important that you send invoices and receipts to your customers in the same currency they used while shopping in your store.

Sufio is an invoicing app for online stores that automatically creates and sends invoices in correct currencies.

Some ecommerce platforms like Shopify are able to display product prices in different currencies, but only allow payments in one base currency during the checkout. Sufio is not able to modify the checkout itself, but lets the customer pay the invoice in their local currency afterwards.

Invoices for Shopify stores in multiple currencies

Let Sufio automatically send invoices and receipts in correct currency for every order made in your store.

Install Sufio - Invoices in multiple currencies from the Shopify App Store