Beginning on January 1, 2025, electronic invoicing becomes the default method of invoicing for B2B sales in Germany. Every company based in Germany is required to accept e-invoices for its purchases.

This article provides guidance on e-invoicing requirements for Shopify stores based in Germany and explains how Sufio automatically generates compliant e-invoices.

- E-invoicing laws in Germany

- German e-invoicing for Shopify stores selling B2B

- Support for e-invoices in Sufio

From January 1, 2025, companies based in Germany are legally required to receive e-invoices for their purchases.

While suppliers can still issue paper invoices or invoices in unstructured formats with the buyer's consent, the official recommendation is to issue e-invoices to streamline processes and enhance efficiency.

Starting January 1, 2027, companies with a previous year’s turnover of over €800,000 will no longer be permitted to issue invoices in unstructured electronic format. Beginning January 1, 2028, this obligation will apply to all remaining companies.

These rules for e-invoicing in Germany were introduced by the Growth Opportunities Act (Wachstumschancengesetz), passed in 2024.

For Germany, the prescribed invoice format is called ZUGFeRD.

ZUGFeRD—short for Zentraler User Guide des Forums elektronische Rechnung Deutschland—is a standardized German electronic invoice format designed to facilitate efficient and secure exchange of invoices between businesses (B2B) and between businesses and government entities (B2G).

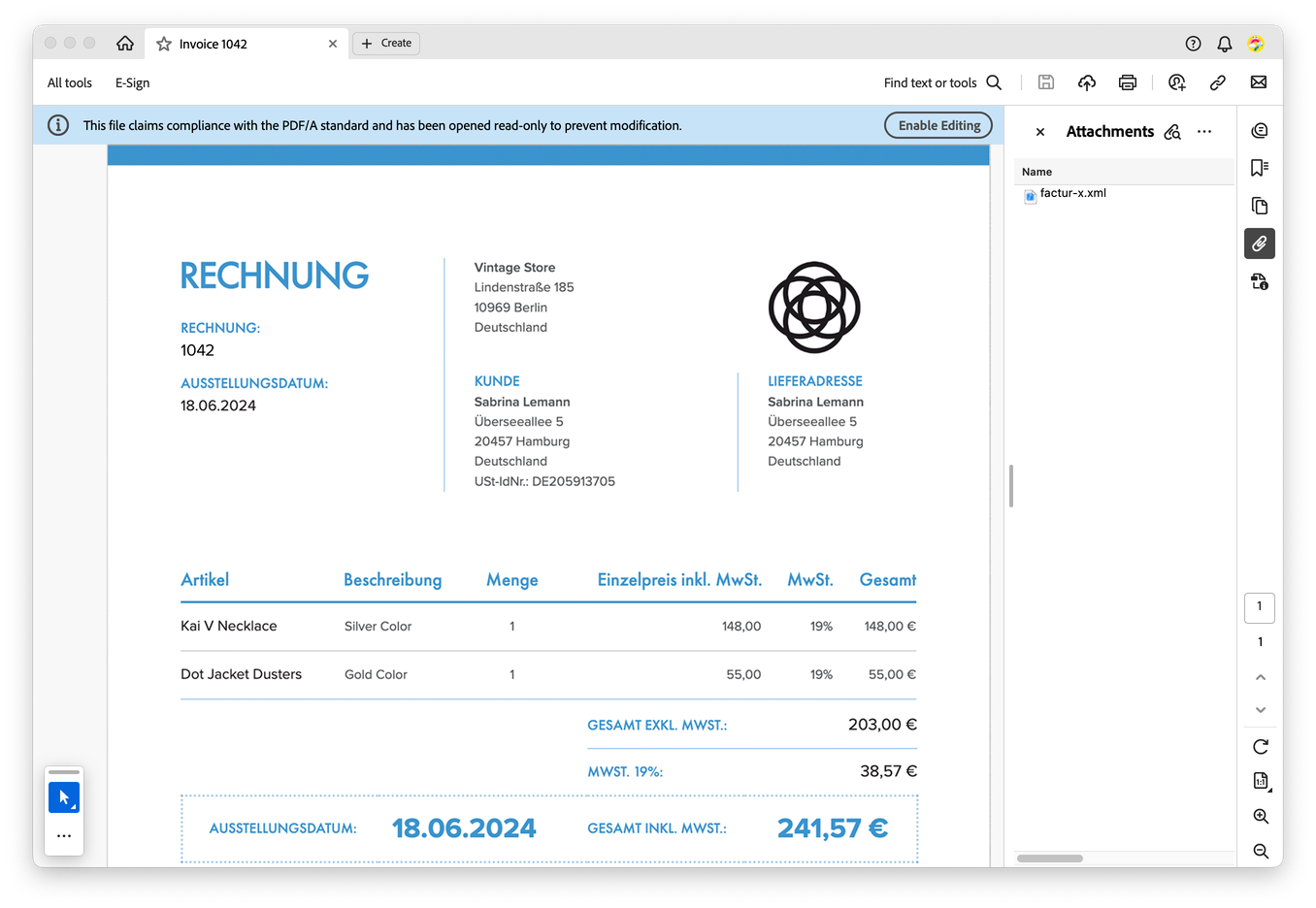

The format combines human-readable PDF documents (PDF/A-3) with attached machine-readable XML files containing all invoice data in a structured format. This enables both easy readability for humans and efficient, automated processing by computer systems.

ZUGFeRD adheres to EU standards (EN16931), ensuring compliance with European directives on e-invoicing (Directive 2014/55/EU) and supporting cross-border trade.

The format is identical to the Factur-X format used by e-invoices in France.

German e-invoicing legislation also permits the use of XRechnung format, which is a purely XML-based format without an embedded visual representation of the invoice. However, this format is mostly intended for public sector invoicing in Germany (B2G).

As a merchant, you may currently continue to issue paper invoices or invoices in unstructured format, provided that you obtain the buyer’s consent.

However, this is a temporary exception, and it is recommended that businesses begin issuing e-invoices for their B2B sales.

Shopify stores in Germany selling to business customers (B2B) should issue e-invoices in the ZUGFeRD format.

From January 1, 2025, all invoices and credit notes created by Sufio for accounts based in Germany automatically include structured invoice data in the ZUGFeRD format.

Invoice data is included in both invoices automatically created from orders in Shopify stores and those manually created in the Sufio app.

The same applies to credit notes, which are added to both those automatically created from refunds and returns in the online store and those created manually in the app.

Sufio includes invoice data as XML files in the ZUGFeRD 2.3 format in the EN16931 (COMFORT) profile.

The XML files are attached to the PDF documents that can be downloaded in the app and are sent to customers. When an invoice or a credit note includes an XML file, an e-invoice badge is displayed in the online view of the document.

If you want to see the invoice data attached to the XML file, you can use a PDF viewer that support opening attachments, such as Adobe Acrobat.

No action is required on your part to enable the creation of invoices in the ZUGFeRD format. If your store is based in Germany, Sufio automatically creates documents in this format.

Note

ZUGFeRD format support in Sufio is currently in public beta and available for all users from Germany. We value your feedback—please contact our support team with any questions or suggestions.

German invoices for Shopify stores

Let Sufio automatically send invoices and receipts for every order made in your store.

Get Sufio - Invoices for German stores from the Shopify App Store