In 2025, a pilot program will begin for e-invoicing for B2B sales in France. Over the next years, it will become mandatory for all businesses to issue e-invoices.

This article provides guidance on e-invoicing requirements for Shopify stores based in France and explains how Sufio automatically generates compliant e-invoices.

- E-invoicing laws in France

- French e-invoicing for Shopify stores selling B2B

- Support for e-invoices in Sufio

Starting September 1, 2026, all French companies must be able to receive e-invoices.

From the same date, medium- and large-sized companies will be required to issue e-invoices. These are companies with more than 250 employees and exceeding either €50 million in annual turnover or €43 million in balance sheet total.

From September 1, 2027, all companies—including small and micro-enterprises—must issue e-invoices. These deadlines were introduced in the Finance Act for 2024, passed in 2023.

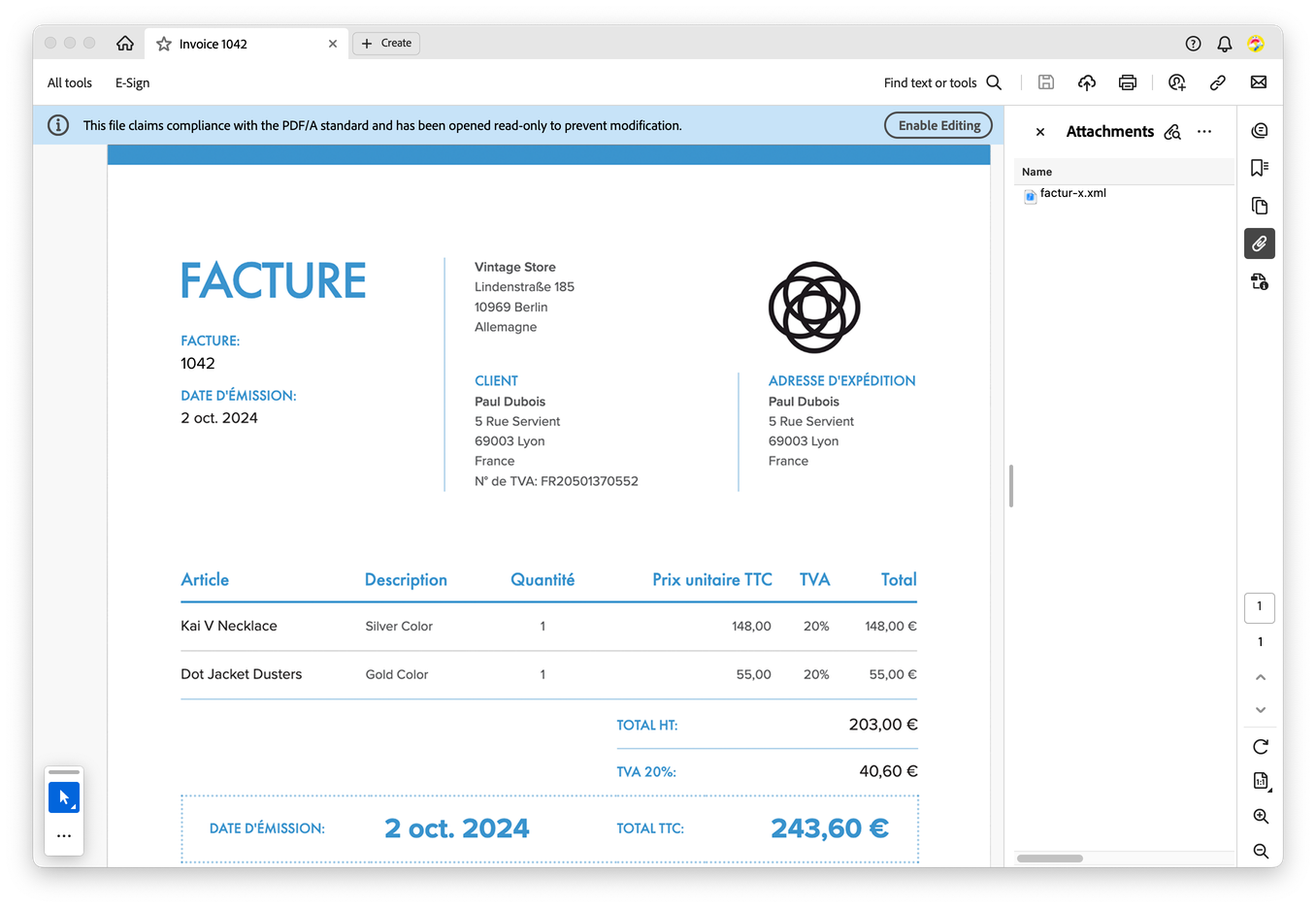

French e-invoicing legislation mandates the use of the Factur-X format for B2B invoices.

Factur-X is a standardized French electronic invoice format designed to facilitate efficient and secure exchange of invoices between businesses (B2B) and between businesses and government entities (B2G).

The format combines human-readable PDF documents (PDF/A-3) with attached machine-readable XML files containing all invoice data in a structured format. This enables both easy readability for humans and efficient, automated processing by computer systems.

Factur-X adheres to EU standards (EN16931), ensuring compliance with European directives on e-invoicing (Directive 2014/55/EU) and supporting cross-border trade.

The format is identical to the ZUGFeRD format used by e-invoices in Germany.

As a merchant, you may currently continue to issue paper invoices or invoices in unstructured format. However, this is a temporary exception, and it is recommended that businesses begin issuing e-invoices for their B2B sales.

Shopify stores selling to business customers (B2B) should issue e-invoices in the Factur-X format.

From January 1, 2025, all invoices and credit notes created by Sufio for accounts based in France automatically include structured invoice data in the Factur-X format.

Invoice data is included in both invoices automatically created from orders in Shopify stores and those manually created in the Sufio app.

The same applies to credit notes, which are added to both those automatically created from refunds and returns in the online store and those created manually in the app.

The XML files are attached to the PDF documents that can be downloaded in the app and are sent to customers. When an invoice or a credit note includes an XML file, an e-invoice badge is displayed in the online view of the document.

If you want to see the invoice data attached to the XML file, you can use a PDF viewer that support opening attachments, such as Adobe Acrobat.

No action is required on your part to enable the creation of invoices in the Factur-X format. If your store is based in France, Sufio automatically creates documents in this format.

Note

Factur-X format support in Sufio is currently in public beta and available for all users from France. We value your feedback—please contact our support team with any questions or suggestions.

French invoices for Shopify stores

Let Sufio automatically send invoices and receipts for every order made in your store.

Get Sufio - Invoices for French stores from the Shopify App Store