Starting on Shopify? Here's how to Register Your Business in the UK

Starting an online business can feel like a big step, but with platforms like Shopify, the process is more manageable than you might think.

If you're based in the UK and ready to get started, one of the first things you'll need to do is register your business.

This guide will walk you through the essential steps to set up your small business in the UK, ensuring you have a solid foundation before you launch an online store.

Whether you're planning to operate as a sole trader or form a partnership, we'll cover the key points to help you get up and running smoothly.

Why register your Shopify business?

Registering your business—even if it's just a small Shopify venture—is a crucial step in the UK. It ensures you're operating legally, helping you avoid potential HMRC fines and other related issues.

Registration also enhances your credibility with customers, suppliers, and financial institutions. It opens doors to better banking services, loans, and business partnerships, all of which are essential for growth.

Lastly, proper registration forces you to manage your taxes and financial obligations more effectively. It allows you to keep accurate records and file tax returns properly, simplifying financial management and preparing you for future audits.

Choosing the right structure for your UK Shopify store

Before registering your Shopify business, you'll need to choose a business structure.

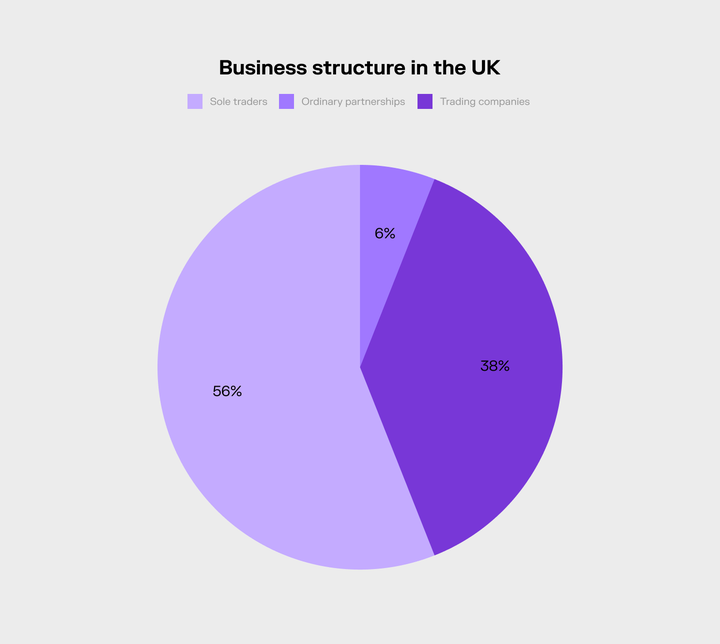

In the UK, there are three primary business structures to consider:

- Sole Trader: The simplest form, where you are the sole owner and responsible for all aspects of the business. You keep all profits, but you are personally liable for any debts.

- Partnership: Involves two or more people sharing ownership, responsibilities, and profits. Partners are jointly liable for the business debts.

- Limited Company: A separate legal entity where liability is limited to the company's assets. It offers protection for personal assets and can provide tax advantages, but involves more administrative tasks.

According to the UK's 2024 Business Population Estimates, 56% of the private sector business population are sole traders, 38% are actively trading companies, and 6% are ordinary partnerships.

Each structure has its own advantages, so choose the one that best fits your business needs and goals.

Registering as a sole trader

To register as a sole trader in the UK, you first need to notify HM Revenue & Customs (HMRC) that you are self-employed. This is done by registering for self assessment.

Start by creating or signing in to your HMRC business tax account. This is also called the Government Gateway account, and it allows you to access various online government services securely.

Once you’re logged in, navigate to the self-employed registration form and fill it out. The form will ask for details such as what type of tax you want to register your business for—this is where you select self assessment.

You will need your national insurance number for this form. If you don't already have one, you can apply for it before you register.

The final step is to wait for your unique taxpayer reference (UTR) number. This is a 10-digit number that's crucial for filing your self assessment tax returns and managing your tax affairs. Keep it safe, as you'll need it for all future communications with HMRC.

If you can't register online, you can register by post using the CWF1 form.

As a sole trader, you should register your company by October 5th of your business's second tax year.

Record keeping and tax obligations

As a sole trader, you'll need to pay income tax on your profits and national insurance based on your class.

This amount is calculated based on your income, which in this case is your profits. You must file a self assessment tax return every year detailing this, so it's important to maintain accurate records of your business income and expenses.

VAT may also apply depending on how much you make each year.

Registering as a partnership

A partnership consists of 2 entities: the partnership itself and the partners involved. All of these need to register for self assessment, but separately and in slightly different ways.

First, you must appoint a nominated partner—this is the partner that will be responsible for managing the partnership’s tax returns and business records. In simple terms: they are the partner that receives communications from HMRC.

Aside from this, every partner in the partnership (including the nominated partner) must file their own self assessment that is separate from the partnership's self assessment.

Registering if you are the nominated partner

The nominated partner must register the partnership for self assessment using the SA400 form. They will need a Government Gateway user ID and their UTR number or VAT reference number. Both of these can be found in their HMRC business tax account.

Then they must register themselves as a partner in the partnership using the SA401 form. This registers them for self assessment and class 2 National Insurance contributions.

If you are unable to register online, both of these forms are available to download so you can fill them out and post them to HMRC.

Registering if you are a partner

If you’re not the nominated partner and are joining a partnership, you can only register yourself for self assessment and class 2 national insurance contributions via post.

You can use the same form as your nominated partner (SA401).

Similarly to sole traders, partnerships and partners need to be registered by the 5th of October in the partnership's second tax year.

Record keeping and tax obligations

Individual partners are only responsible for filing their personal tax returns detailing their income tax and national insurance contributions (NICs). Nominated partners must file this, as well as a separate tax return for the partnership itself.

Depending on the business's annual turnover, VAT may also be applicable.

Registering as a limited company

The gov.uk website has a step-by-step guide on how to set up a limited company, but we will also summarize the steps here:

- Choose a company name that complies with the rules set by Companies House. Then, appoint at least one director—who is responsible for managing the company's affairs—and a company secretary (if applicable).

- You'll need at least one shareholder. If you are the only employee of the company (making you the director), then as the only shareholder, you'll own 100% of the company.

- Prepare the necessary documents. This includes a Memorandum of Association— a legal statement signed by all initial shareholders agreeing to form the company—and Articles of Association, which outline the rules for running the company.

- Register the company with Companies House. The current fee is £50 for online registration, but if you don't want 'limited' in your company name, or are unable to register online, you can fill out the IN01 form and send it by post. Postal applications cost £71. It's important to note that the company requires its own Government Gateway user ID—you can't use your personal one.

- If you registered your company online, you'll most likely automatically be registered for corporation tax, too. If not, you are responsible for registering corporation tax to your business tax account.

Record keeping and tax obligations

Aside from income tax, NICs and VAT (if applicable), limited companies must submit an annual corporation tax return (form CT600) to HMRC and pay corporation tax on their profits.

Tip

Do you need to know when your business is required to pay UK VAT? Read through Sufio’s VAT guide for Shopify stores in the UK to get all the information you need.

Next steps for your UK Shopify business

After you register your business in the UK, you will need a reliable invoicing solution to keep your business compliant with local regulations. That's where Sufio comes in.

Trusted by over 6,000 successful merchants from over 100 countries, our app lets you create and send Shopify invoices and credit notes automatically.

Try the 14-day free trial and start generating UK-compliant invoices today!

Professional invoices for Shopify stores

Let Sufio automatically create and send beautiful invoices for every order in your store.

Install Sufio - Automatic Invoices from the Shopify App Store